The latest plot turn in the Greek drama has this strategist rethinking his euro view.

Just when you think the final act in the Greek drama is close, another surprise emerges. This week has been no different, with Greece finally, painfully approving an austerity budget, only to have international lenders delay a decision on its next tranche of aid.

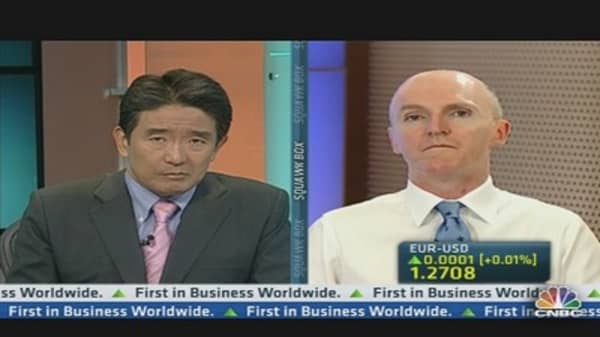

The whole mess has Sean Callow, senior currency strategist at Westpac, rethinking his euro outlook.

"We've been quite upbeat on the euro for the past few months," he told CNBC, since European Central Bank President Mario Draghi vowed to do whatever is needed to preserve the common currency. But the lenders' intransigence is giving him pause. "They're really making Greece pay," he says.