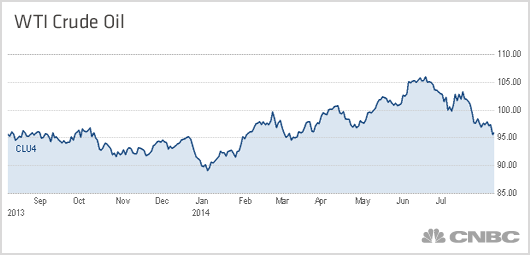

I expect to see more declines in the future, though, I must admit, I am surprised by the persistent weakness in crude oil amid mounting geopolitical tensions in oil-sensitive parts of the world.

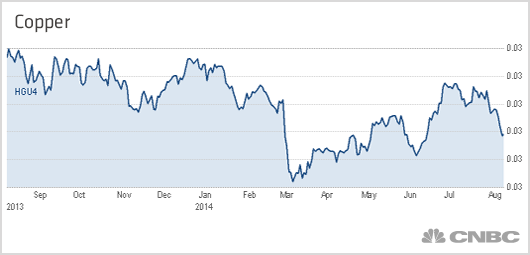

So, what are commodities telling us, not only about inflation, but about global growth?

Well, outside of the UK and U.S., the "message of the markets" seems quite clear: The world is again on the cusp of declining growth and, possibly, worldwide recession.

Read MorePPI capped by drop in energy prices

Consider that Japan's economy contracted at a nearly 8 percent annual rate in the second quarter. European second-quarter GDP was flat as Italy entered a rare "triple-dip recession," while France AND Germany are struggling to keep their economies from slipping into negative growth.

And, it's unlikely that China's growth, in real terms, will meet the government's 7.4-percent target.

(Copper is a key "tell" here as it is highly correlated to China's GDP.)

Russia is on the brink of recession; Brazil is struggling, while other emerging market nations are scraping by.

All of that is reflected, not only in the persistent weakness of commodities, but the record low bond yields we are witnessing around the world.

Read More10 economies hit hard by climate change

The drop in the 10-Year German bund rate, to just a hair above 1 percent, is indicative of the global slowdown that is, in part, driven by geopolitical uncertainties and trade sanctions against Russia.

But one could also argue that monetary, and fiscal, policies in Europe, Japan, Russia and China are not sufficiently loose to shore up these struggling economies.

Commodity markets are making that quite plain.

Certainly, in relative terms, the U.S. looks far better and will actually be helped by the decline in commodity prices, particularly the rather sharp plunge in crude oil and, what is an accelerating drop in gas prices at the pump.

Given last month's sluggish retail sales data, consumers could use a little extra disposable income not wasted on gas.

The U.S. is increasingly becoming a self-sustaining, stand-alone economy that is increasingly immune to global economic weakness and potential shocks.

Read MoreJim Cramer: Here's what will move oil prices

I would watch commodity prices even more closely from here on out. They are sending a yellow signal about global growth, as are domestic, and worldwide, bond yields.

The good news remains that the drop in commodity prices dampens inflationary pressures and allows central banks, including the Federal Reserve, to stay looser for longer.

The bad news is that the U.S. needs to accelerate its drive toward domestic production and increased consumption to ward off any global ills that bond yields and commodity prices may well be forecasting.

Commentary by Ron Insana, a CNBC and MSNBC contributor and the author of four books on Wall Street. He also delivers a daily podcast, "Insana Insights," and a long-form weekly version, both available on iTunes and at roninsana.com. Follow him on Twitter @rinsana.