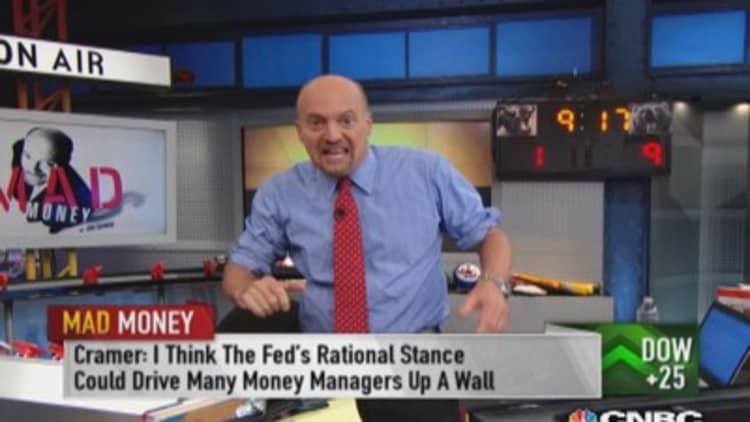

Jim Cramer spent Wednesday afternoon sifting through and the comments made by in the subsequent press conference.

He thinks is loud and clear.

"As I listened, I heard a woman who was simply saying, look, the Great Recession is still with us psychologically. We aren't back to normal, because the downturn so scarred people that they aren't behaving as we would hope." Cramer said. "It's clear to me she's worried that the psyche of the country is too fragile."

What does her view mean for stock investors who are trying to make you money?

"The trick with the Yellen regime, like the trick with the Ben Bernanke regime before her is to remember that they speak for the common person," Cramer said. "The Fed wants the common person to make money."

In turn, Cramer believes the resulting policies and initiatives put into place will reflect that fundamental tenet. Therefore, he says the way to make money in the market is to find companies that benefit from this consumer-friendly environment, and then, establish new positions, strategically.

For example, "Why not own some Apple, it's much cheaper than the average stock," Cramer said. And with the Fed committed to helping the average Joe, more people should have more disposable income, a tailwind for Apple products.

Also, Cramer suggested looking at retailers that are focused domestically. "Knowing that the Fed's not going to tighten credit and given gasoline is lower, I think there's plenty of opportunity there."

In addition, Cramer thinks companies such as Facebook and Google warrant attention, in part because they're able to thrive in a sluggish economy.

Also, with rates remaining at historic lows, Cramer thinks good companies that generate solid yields such as Verizon, Kinder Morgan or Ventas will attract dollars. "Or maybe Microsoft, which raised the dividend today and can do so much more to bring out value. "

--------------------------------------------------------------

Read more from Mad Money with Jim Cramer

Will Alibaba kill bull or feed it?

Could new drug arrest cancer?

Behind Apple's recent decline

--------------------------------------------------------------

Of course, there are many more opportunities; the key here, is that they're all in the stock market. "The common person can't make it with certificates of deposits, and the Fed knows that," Cramer said. Through their statement on Wednesday, they are urging you to put money to work in stocks, the ones that can go higher."

Cramer knows many people remain cautious of stocks. If you're among them, he again suggests really digesting the commentary today from Janet Yellen. "She told you she's going to take her time (before raising rates), so you can comfortably get your feet wet in the stock waters."

"Many companies are making tons of money," Cramer added. If you hold the stocks of good companies in an investment portfolio, you could be, too.

(Click for video of this Mad Money segment)

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com