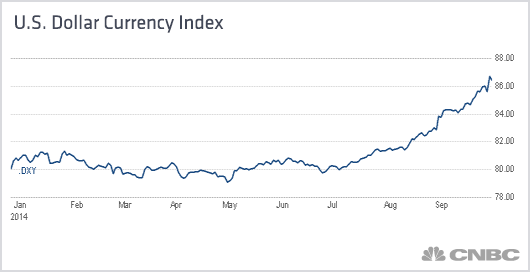

The rebound in the dollar is both good and bad for the economy, depending on your point of view. As it pertains to inflation, and Fed policy, the news is quite good, though a stronger dollar also makes U.S. exports more expensive overseas and cuts into the profits of multinational corporations that sell their goods abroad. By weakening exports, a strong dollar also has the potential slow GDP growth, something that no one is counting on at the moment, and another reason the Fed may be watching the dollar more closely than you think.

Read MoreFive reasons the Fed should raise rates now

Most importantly, for the moment, is that a stronger dollar works to dampen inflation by lowering the cost of commodities that are priced in dollars -- particularly oil. Broadly speaking, a stronger dollar puts downward pressure on imported inflation and allows U.S. consumers greater purchasing power, which, in and of itself, is disinflationary.

It's most notable in oil, for which consumers shell out a great deal of money. As the dollar has strengthened of late, oil and gasoline prices have tumbled, as have other commodities, like gold, silver, copper and agricultural goods.

As the dollar rallied, oil has fallen from a high of $107, earlier this year, to about $90 today, a decline of nearly 16 percent. Gasoline prices have fallen to the low $3 a gallon range for regular unleaded, the lowest level of the year.

All this means that headline inflation will continue to move below the Fed's 2-percent target, even as the employment data improve. This gives the Fed plenty of leeway to delay a rate hike, since the dollar's rally is putting a lid on inflation and, quite possibly, driving inflation too low for the Fed's liking.

Read MoreOp-ed: Ben Bernanke, I feel your pain!

This is very important. Even if the Fed's employment mandate is being met -- its inflation target is not.

With deflation a real threat from overseas economies, coupled with rapidly weakening economic growth from Brazil to Beijing, the Fed must factor the dollar into its policy-setting equations.