China is moving into the United States' backyard—but it's not clear if this is a bad thing for anyone.

Beijing is directing an increasing amount investment into Latin America, raising sphere-of-influence worries in the U.S. and trepidation among some local enterprises. But experts tell CNBC that—with the important exception of the environmental degradation typically brought on by Chinese business interests—the situation is benefiting everyone involved.

China's involvement in Latin America can be seen as an extension of its 1999 Go Out policy, which said the country should invest abroad to secure access to natural resources, gain new markets for exports and internationalize Chinese firms. Despite this open strategy—Beijing explicitly addressed its interest in Latin America in a 2011 white paper—the growth of China's involvement in the region has taken many by surprise.

"We all thought it was a pie-in-the-sky effort. ... The relationship has changed at an incredible rate since that document, to the point now that China is an important partner for the region economically and politically," said Margaret Myers, director of the Inter-American Dialogue's China and Latin America program.

Read More Beijing still funds struggling Venezuela, for now

Calling China's growing investment in the region "remarkable," Myers said that policy analysts had once considered the possibility of a Chinese exit from Latin America, but now see the country as firmly entrenched there.

In fact, China is close to overtaking the European Union as Latin America's second largest trading partner, according to the United Nations.

Chinese investments in the region have also skyrocketed: The country invested only $231 million there in 2005, but by 2010, investment had jumped to $37 billion, according to data from the Inter-American Dialogue. Through 2013, the China Development Bank has loaned $78.3 billion to Latin America.

Several major projects center on transport, including a China-backed $10 billion railway plan to connect Peru's Pacific coast and Brazil's Atlantic coast, which wouldfacilitate the export of raw materials such as copper, gold, silver and iron ore.

China has also loaned $2.1 billion to Argentina for a grain-transporting rail system, and has bid on a scandal-plagued $3.7 billion Mexican high-speed rail development contract.

Read MoreMexican leader hit by China-linked scandal

Natural resources from Latin American are critical for China. In Peru alone, Chinese firms have recently invested $1.2 billion in an iron ore mine and $3.5 billion in a copper mine. Beijing-backed firms are also engaged in lithium mining and development in Bolivia.

Alternatives to the Panama Canal—including in Colombia and Nicaragua—have been linked to China, possibly indicating Beijing's concerns about maintaining transportation security. There's also China's long history of investing in Cuba.

Read MoreMore US and less China could be a good thing for Cuba

China's interest in extending its Go Out policy to America makes sense given the resources and allure of emerging market consumers. But many Chinese companies claim to operate independent of Beijing's directives—this includes Guodian Corp., which has major operations in Brazil's energy sector, Myers said.

While some allege that Chinese companies are always acting on Beijing's orders, Myers said that impression is erroneous, pointing out that most of the oil extracted in Latin America is sold on the international market, as opposed to being sent back to China.

Even if Chinese firms are acting in concert with Beijing's interests, the Chinese leadership claims Beijing is not trying to exploit its Latin American partners.

"China is experimenting with something no major power has tried before: making win-win cooperation the basic tenet of international relations," Wu Baiyi, a fellow at the Chinese Academy of Social Sciences, wrote in a reflection of the recent China-Community of Latin American and Caribbean States Forum.

At that event, Chinese President Xi Jinping promised to expedite a $20 billion loan for infrastructure, a $10 billion concessional loan and $50 million agricultural loan to the region. Xi set a goal of $500 billion in two-way trade and $250 billion in Chinese investments to Latin America in the next 10 years.

Read MoreVenezuela needs cash, but there's no easy way to get it

"Our two sides have designed an exquisite emblem for the forum," he said at the meeting earlier this month. "It is in the shape of a pair of peace doves or two clasped hands, which symbolizes close cooperation between the two sides soaring to great heights."

Such overtures have not stopped some from concluding that China is planning to gouge Latin America and harm local businesses, while others doubt Xi's ability to make good on all its promises.

"The political leadership in China wants to use its resources to expand its influence in many parts of the world, but that capacity is very limited," Victor Shih, a professor at the University of California, San Diego, who specializes in China's finances.

China has secured about half the oil production from Ecuador and Venezuela, but Beijing is exposing itself to risk as it does so—in fact, the reason the Chinese were able to secure those deals in the first place is because they are effectively a "lender of last resort" for much of the region, Myers said.

Since 2007, China has loaned Venezuela more than $50 billion to fund infrastructure, housing and mining projects, which the ailing OPEC member repays in oil shipments. About half of the oil, including fuel oil, that Venezuela ships to China is earmarked explicitly to repay its debts.

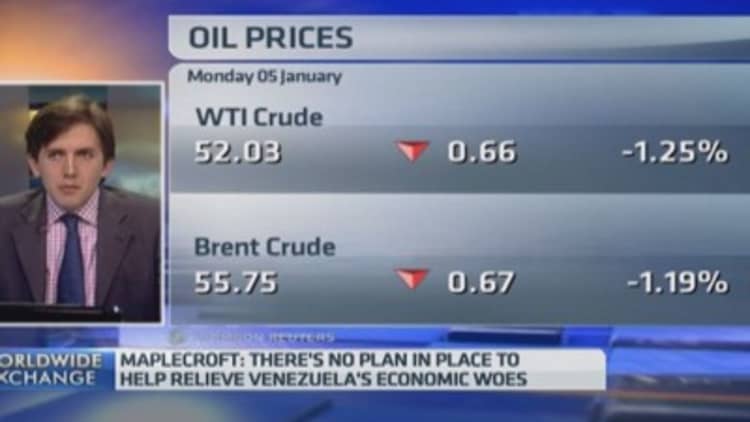

But Venezuela has not been a good debtor. Between January and October, oil shipments to China averaged 312,000 barrels per day, compared with 360,000 barrels per day during the period in 2013, according to ClipperData, a New York-based firm that tracks data of crude shipments around the world.

"Venezuela preferred to sell the oil to somebody that was going to pay them with new cash rather than somebody who has already paid them the cash. So they diverted their crude elsewhere," said Abudi Zein, ClipperData's chief operating officer and co-founder.

As for the U.S., Myers said American firms are not likely to see much of a downside from Chinese involvement since its interests are much more diversified than those of China, which mostly concern resources and transport.

Read More How China views the state of the global economy

And while aid from Beijing may diminish Washington's standing in the region, the U.S. government has made a point of directing its attention to other parts of the globe and could defend its Latin American interests if it wanted, she said.

In fact, a 2012 paper from the American University School of International Service concluded that a Chinese role in the region is "not an imminent threat to the United States," and the U.S. "should welcome China's involvement in [Latin American and the Caribbean] by encouraging it to be a responsible and productive stakeholder."

"Engaging China multilaterally in the region can benefit not only Latin America, the Caribbean, and China, but also the United States," the paper argued.

—CNBC's Silvana Ordoñez contributed to this report.