SolarCity CEO Lyndon Rive was none too pleased with Jim Chanos, head of the world's largest short-selling hedge fund, after he revealed on CNBC Friday that SolarCity is one of his firm's biggest short positions in renewable energy. The call sent SolarCity's shares down 12 percent.

In fact, Rive was so distraught by Chanos' comparison of his company to a subprime financier that he took it upon himself to call in to CNBC's "Options Action" to rebut him.

"I just don't think he got his facts straight," Rive said. "We sell them energy at a lower rate than they can buy from the utility today, so the likelihood they are going to default on us is extremely low," noting that the default rate for customers was around a half percent over the last eight years.

Rive further clarified that the subprime market was defined by a FICO score of 640, below the lowest credit score Solar City accepts of 650 and far lower than the average customer score of 750.

Read More Harry Reid enters Nevada's solar wars

Chanos, the founder of Kynikos Associates, earlier Friday stated his concerns with SolarCity's residential model, which he believes acts more like a subprime financing company than an energy provider.

"Solar is a transformational industry, and it's going to be a great thing and part of it is because cost for everything keep coming down," Chanos said. "That's a problem if you are SolarCity, and your customers are paying you this above market prices and you hope to sell more systems."

Read More The sleeping giant of the solar industry: Florida

SolarCity, founded in part by Tesla's CEO Elon Musk, was down more than 10 percent in trading on Friday and reported an earnings miss last month. However, the with $103 million in the second quarter.

"SolarCity is burning an awful lot of cash, hundreds of millions of dollars every quarter, has a lot of debt and has negative EBITDA," Chanos added. "And in this kind of environment that is a very scary proposition. I mean, they are going to have to raise a lot of money in a model that I think has been passed over in terms of the more institutionalized and distributed model of solar."

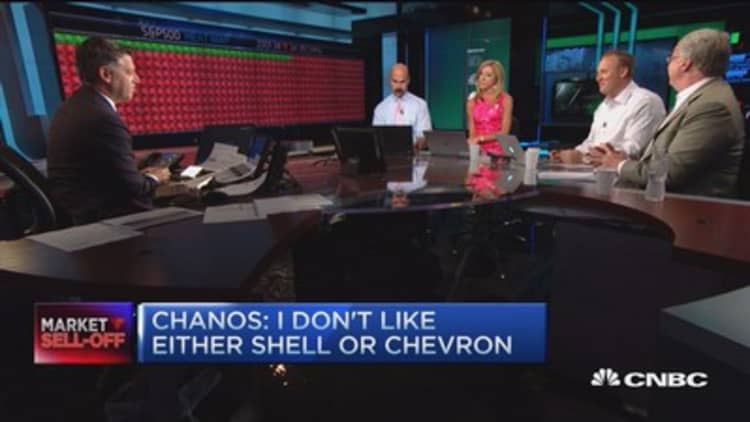

Chanos also expressed pessimism in regards to Shell and Chevron, who he says are not economic because they are building capacity in an area in which demand has fallen flat.