When Republican presidential candidates meet for the next GOP debate on Wednesday, they will surely have to address the issue of income and wealth inequality. Unlike the Democrats, though, whose main remedy is to condemn Wall Street "greed" and seek retribution through redistribution, the Republicans need to bring up the role of monetary policy in skewing financial outcomes.

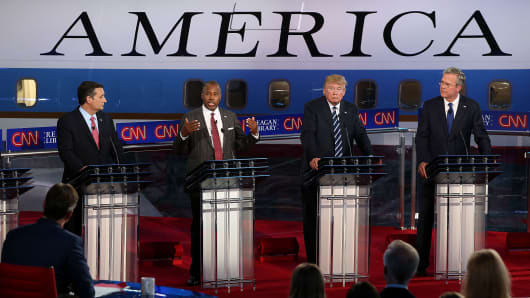

It won't be an easy task – it's not sound-bite material – but it's vital to counter the narrative being put forth by leading Democratic candidates Bernie Sanders and Hillary Clinton that attacks "millionaires and billionaires" for racking up big profits in financial markets. Let's hope that someone on the Republican dais on October 28 will have the courage to wade into the role of the Federal Reserve as a major contributing factor to the 2008 global financial crisis – the one that devastated our economy and pitted citizens against each other.