Cyndi and Ron Williams, both 57, admit they are not as financially secure as they want to be. Like many baby boomers, they say the vision they had for their lives 20 to 25 years ago is not the reality they are living now.

"I had these visions of getting ready to retire, being able to go here, go there and just have money because I have worked hard for decades," said Cyndi, an IT project manager in Bowie, Maryland. "I'm not saying that I don't have flexibility, but there is a gap between the flexibility that I thought I would have and where I am now."

Job changes, layoffs, helping children through college — life events (some unexpected) caused them to make a few financial missteps along the way, she said.

Both grew up in "solidly middle-class" African-American families, but Ron says that while education was always emphasized, financial literacy was not.

"When you miss steps midway, they become more critical the older you get," said Ron, who is dean of the business school at Coppin State University, a historically black college in Baltimore.

While ensuring a secure retirement is a struggle for many Americans, the problem is much more acute for blacks than whites, even those in the middle class, according to the National Institute on Retirement Security.

About 62 percent of black working-age households have no assets in a retirement account, compared to 37 percent of white households. Only 25 percent of black households have more than $10,000 in retirement savings, about half as many as white households. Another report, from the Urban Institute, finds that white families on average have over $100,000 more in retirement savings than African-American families.

This racial divide in savings contributes to worsening inequality in overall wealth. A 2015 Federal Reserve report found the net worth of white families is considerably greater than that of black families, and the gulf that separates them has changed little over the last 25 years. "Life-cycle dynamics, educational attainment, inheritances, and portfolio composition — particularly, residential real estate — all play an important role," the report's authors said.

Some of these factors have contributed to disparities in investing. African Americans have far less money in the stock market than whites. A recent survey by Ariel Investments found that among those with incomes of at least $50,000, only 67 percent of blacks own stocks or mutual funds, compared with 86 percent of whites.

Ten years ago, when asked directly whether the stock market or home improvement is the better investment, 64 percent of African Americans in the Ariel study chose home improvement, a number that holds steady today.

For African Americans, wealth translates to tangible property, like homes, and so what we have seen with the housing crisis is that it's been harder for African Americans to rebound, said Lazetta Rainey Braxton, a certified financial planner and founder of the wealth advisory firm Financial Fountains.

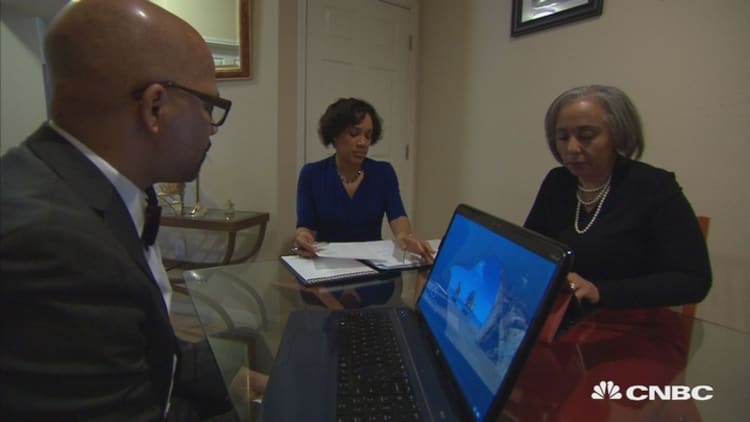

Braxton works with clients, including the Williamses, to help them understand how to invest strategically to build wealth.

"When you make strong, clear financial decisions, the momentum really allows your wealth to grow exponentially. ... Financial advice certainly will narrow the wealth gap," said Braxton, who is also president the Association of African American Financial Advisors, known also as Quad A. Her group is working with the Financial Planning Association, the country's largest membership organization for financial advisors, to bring more blacks into the profession and bring financial advice to more African Americans.

"We are not a community that has a long history of wealth," said Braxton. "This is an area where it can be hard for people to study on their own. So to have someone who is very passionate about making good financial decisions being exposed to tools and opportunities that help you move forward in realizing your dreams and goals, it just takes someone to walk with you."

Yet only 6 percent of U.S. financial advisors are black, according to recent Census data. FPA chair Ed Gjertsen says increasing diversity among financial professionals helps more people, as "they're able to take that message back to their communities and help those individuals close that gap."

The Williamses agree: Finding an advisor who understands their needs has helped them build trust. Together, they are planning how they can increase their wealth — and eventually retire.

Watch CNBC's "Power Lunch" each day this week to see the work being done to bridge America's divide.