Don't expect Saudi Arabia's new oil boss to bring big change to OPEC's June meeting, analysts warned, after the energy power replaced its long-serving minister Ali al-Naimi on Saturday.

"Al-Naimi's removal is less a reflection on [his] policies, which really have carried the kingdom through two decades of highs and lows in the oil markets, than a reflection of the tough scope of the work ahead in Saudi Arabia" Emily Hawthorne, Middle East analyst at political consultancy Strafor, told CNBC's "The Rundown".

In a far-reaching government shake-up, , who had been oil minister since 1995, with Khalid al-Falih, the chairman of state-owned oil company Aramco.

The change came after a sustained decline in oil prices; oil prices have fallen as much as 70 percent since mid-2014 amid an energy supply surplus and a slowdown in global demand growth.

Saudi Arabia is one of the world's largest crude oil producer and the de facto leader of the Organization of Petroleum Exporting Countries (OPEC). The exit of the country's high-profile minister comes just ahead of the next OPEC meeting, scheduled for June 2.

The 13-member oil cartel has repeatedly refused to cut supply despite the slide in prices, as Saudi Arabia sticks to its strategy of leveraging its low-cost production to squeeze out higher-cost U.S. shale oil producers.

Saudi Arabia has also reportedly refused to sign up to a production freeze deal unless Iran, which has only recently returned to the oil market and is determined to built its market share, also signs up to the deal.

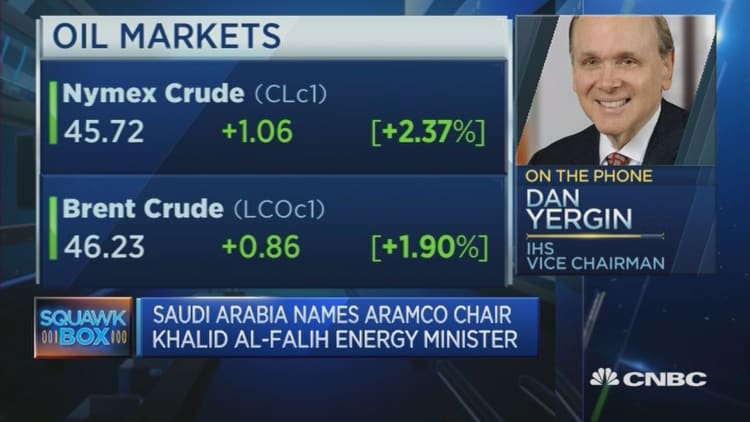

IHS vice chairman Dan Yergin told CNBC's "Squawk Box" on Monday that Saudi Arabia was unlikely to back down in June from this position.

"Al-Falih has said he will continue [Saudi Arabia's intention of allowing] the market determine the market and not have the old days of OPEC trying to manage the market," Yergin said.

On Sunday, al-Falih said he would maintain the country's "stable petroleum policies," according to a Reuters report.

It's also in Saudi's long-term interest to keep crude oil prices low now in order to limit demand shift to alternative fuels such as shale and, at the same time, spur economic change in the kingdom, Taurus Wealth Advisors executive, Rainer Michael Preiss, told CNBC's "Street Signs".

"We remain committed to maintaining our role in international energy markets and strengthening our position as the world's most reliable supplier of energy," al-Falih said in a statement emailed to Reuters.

The Saudi strategy of letting oil prices fall until shale producers can no longer function, however, has taken longer than expected to work, which has taken a toll on the oil income-reliant Saudi economy.

In April, Saudi Arabia unveiled a long-term economic blueprint for life in a low-oil-price world. Titled "Saudi Vision 2030," the plan sets out policy and budgetary changes to be implemented over the next 15 years in the hope of making the kingdom less reliant on crude.

"They are dealing with a lot of internal struggles in the kingdom. Vision 2030 is about broadcasting to the growing youth population that they will have a future in the kingdom and that future is going include less of a reliance on oil," said Strafor's Hawthorne.

"Al-Naimi presided over the kingdom during a time when it was OK for oil to be the absolute bread and butter for the kingdom and now Saudi Arabia is going to embark on the different path…it makes sense to have a different head."

ClipperData's commodity research director, Matt Smith, said that country's move also signaled the growing prominence and power of deputy crown prince Mohammed bin Salman, who is leading the economic overhaul.

"He's sending a message that they are making these decisions; they can make these calls on a more regular basis when needed," Smith told CNBC's "Squawk Box."

U.S. WTI light, sweet crude oil was up 1.7 percent at $45.43 a barrel while Brent crude was up 1.1 percent at $45.88 a barrel on Monday afternoon in Asia, as a huge wildfire in Canada was estimated to have cut daily production capacity by over 1 million barrels a day.