Sometimes Jim Cramer finds himself daydreaming about a fair and honest stock market, and what that would look like. He thinks if Amazon CEO Jeff Bezos were running things, it could quickly democratize the trading process and make it easier for everyone to profit.

"Can you imagine? Instant access to what the big boys have, delivered right to your door. Only Amazon can level the playing field, which is why I'm begging Jeff Bezos, please set it up," the "Mad Money" host said.

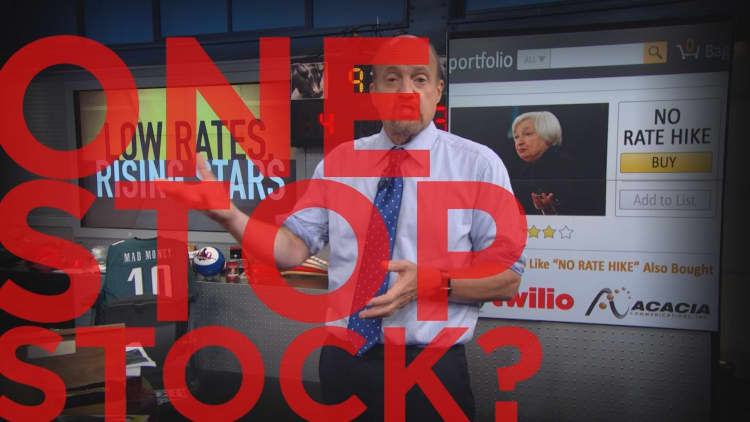

Cramer envisions that Amazon could offer machine-learning capabilities that could accurately prompt investors what to do in the case of a certain event. So, instead of looking for a book on a particular topic, they could look for a stock that can work in different scenarios.

If an investor entered "no rate hike," voila, a list of names would pop up under the category "customers who like 'no rate hike' frequently bought" with corporate icons and stock prices.

"Now, because there is no Amazon button for stocks, everything is lifted ahead of you by the machine gun algorithms directed by high-frequency traders," Cramer said. "If we had this machine learning instrument available on Amazon, I bet we could outrun the algo guys."

The drama over the Federal Reserve's decision not to raise interest rates on Tuesday really bothered Cramer.

"It was a classic misdirection play. The entire episode was like play-acting fake, with you, the audience being the one that got faked out," he said.

This explains why the market had such a fantastic rally on Wednesday after the Fed decided not to tighten. It wiped away all of the losses for one of the most historically terrible months of the year.

Cramer sniffed a rat over the drama leading up to the Fed's decision, though. Going into the Fed meeting there were bets placed and statements made that the Fed would surprisingly hike in September, sending the market tumbling.

As soon as the Fed announced it wouldn't move, the doomsayers mysteriously disappeared. Cramer scoured the wires, boards and Twitter and found nothing. The media acted as if everyone who predicted a surprise rate hike never existed.

Investors had to be kidding themselves if they waited on the sidelines to buy stocks until after the Fed meeting, Cramer said.

Red Hat is the No. 1 provider of Linux-based open-source operating systems for the enterprise that includes middleware, virtualization, storage software and the cloud. Red Hat roared almost 4 percent on Thursday, and Cramer saw it coming from a mile away.

When the company reported in June, the stock was crushed with what was regarded as a disappointing quarter. However, when Cramer spoke with management that day on "Mad Money," they explained the company was doing quite well.

Sure enough, when it reported on Wednesday, Red Hat posted an earnings beat with stronger-than-expected revenue. Management also included a strong forecast for the next quarter and raised full-year sales and earnings guidance.

Cramer was astonished that Red Hat had 60 percent growth in deals over $1 million for the quarter compared to last year. He spoke with Red Hat's CFO Frank Calderoni to learn more.

"It's a great statistic that we saw this past quarter … I think what that really shows is that a larger number of our customers not only are repeating business with us, but are expanding their business," Calderoni said.

With Lululemon's stock down more than 17 percent in the past month, Cramer questioned if the athleisure movement has peaked.

But Lululemon's CEO Laurent Potdevin told Cramer that the brand is about more than just clothing. Thus, he claimed the stock cannot be measured by traditional metrics of a spreadsheet. It is really a combination of the evolution of athleticism and mindfulness, he said.

"It's so much more than apparel … when you think about Lululemon and its history, it's an investment in people," Potdevin said. "Giving them their best life, personal development and creating incredible product that allows them to live their life."

In the Lightning Round, Cramer gave his take on a few caller favorite stocks:

EPR Properties: "Yes, you're getting at almost a 5 percent yield. I say pull the trigger."

E.W. Scripps: "I think people are too negative on that, down 20 percent. I don't want to sell that stock."