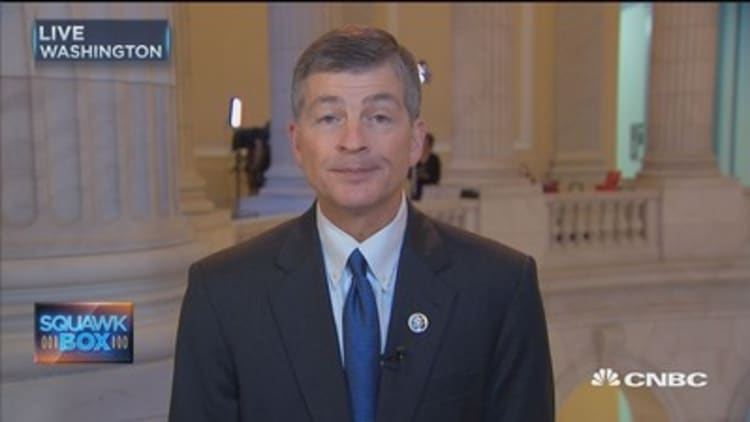

The buck stops with Wells Fargo chief John Stumpf, and lawmakers want to find out what he knew and when he knew about the bank's phony accounts, House Financial Services Chairman Jeb Hensarling told CNBC on Thursday.

In an interview on "Squawk Box" hours ahead of Stumpf's appearance before his committee, the Texas Republican said the scandal has a familiar ring: "Some private institution engages in egregious behavior. There's one headline fine that's barely a rounding error in their earnings statement. And no individual is held accountable. That's got to change."

Earlier this month, Wells Fargo agreed with regulators to pay $185 million in penalties to settle charges fee-generating accounts were opened for unsuspecting customers by employees looking to hit sales targets and bonuses.

The bank said it fired about 5,300 employees over a multiyear period for engaging in those practices.

Congress will hold Stumpf accountable if laws were violated, Hensarling said. "We are demanding documents from regulators and Wells Fargo." The lawmaker also said he wants to know whether regulators were "asleep at the switch."

"When Mr. Stumpf appeared before the Senate last week, he didn't have a lot of answers," the lawmaker said. "So he's had a week to refresh his recollection [and] check his records."

"The bottom line is we want to know how did this take place; why did this take place; who is being held accountable?" Hensarling said.

The announcement on Tuesday that Stumpf agreed to forfeit about $41 million in unvested equity is a step in the right direction, Hensarling said, adding if he were a Wells Fargo shareholder he would be demanding clawbacks.

Stumpf will also forgo his salary while the board conducts investigation into the matter.

Asked whether Stumpf should resign or be removed, Hensarling said such a move would be up to shareholders.

On Wednesday, CNBC reported that sources close to the Wells Fargo board and Stumpf said independent directors were furious over the CEO's handling of the scandal.

Board members feel they were kept in the dark, according to these sources. Sources said the Stumpf camp feels the board was given adequate notice of the situation, and they're throwing the CEO under the bus.

— CNBC's Andrew Ross Sorkin contributed to this report.