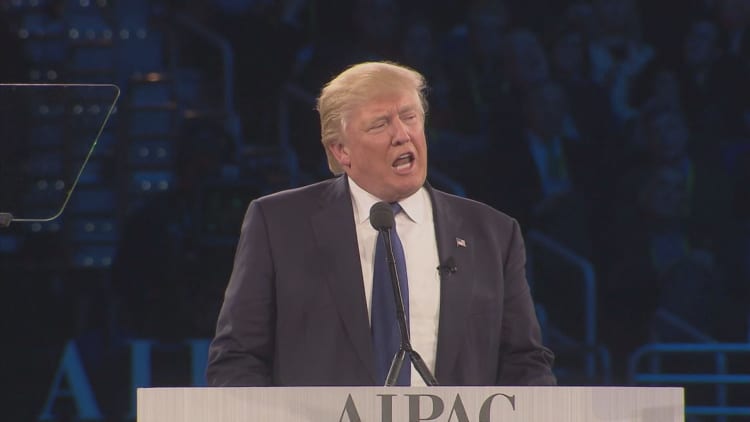

Republican presidential candidate Donald Trump has pledged to impose a 45 percent tariff on imports from China if he were elected, but this may drive U.S. retail price of Chinese made goods up 10 percent, Capital Economics said in a report published on Thursday.

This is due to few alternative suppliers in key product classes that China sells to the U.S., limiting the impact on demand.

"After all, the choice for a U.S. consumer would not be between a more expensive Chinese product and a cheaper U.S. (or other non-China) made one. It would be between buying a more expensive Chinese product and not buying one at all," wrote economists Mark Williams, Julian Evans-Pritchard and Chang Liu.

Half of U.S. imports from China are electronics or machines with the largest individual categories being mobile phones, and tablets and laptops.

By value, China is the source of three quarters of mobile phones and 93 percent of tablets or laptops shipped into the US, the economists said.

The move to hike tariffs may not necessarily bring jobs back to the U.S. either.

"If manufacturers believed that the tariffs were permanent, they would presumably shift investment outside China (though not necessarily to the U.S.)," wrote the economists.

As for China, a complete halt in U.S. goods purchases from the country could hit China's gross domestic product (GDP) by up to 3 percentage points. The impact however would likely be smaller as the Chinese have managed to corner much of the market.

The Chinese government is also likely to pump even more support into the economy.

"Chinese policymakers still have the means to stimulate other sources of demand to offset any slowdown in purchases from the U.S. If Mr Trump were to follow through with his tariff, we would expect policy in China to be eased once again," wrote Capital Economics.

While this may not necessarily help China's export sector or improve its long-term economic outlook, it would help keep the country's GDP from slowing.

Chinese policymakers may also respond to a rise in U.S. retail prices—and demand—by weakening the , U.S. consumers will face a smaller retail price, although such a step would bolster Trump's suggestions that he would label China a "currency manipulator" if he is elected.

The move has no repercussions under the U.S. laws although the Treasury will be required to hold talks with the Chinese authorities on its currency policy—something the U.S. already does, wrote Capital Economics.

Various bills tabled in the last decade to impose penalties on countries given the label have not been passed, the economists noted.