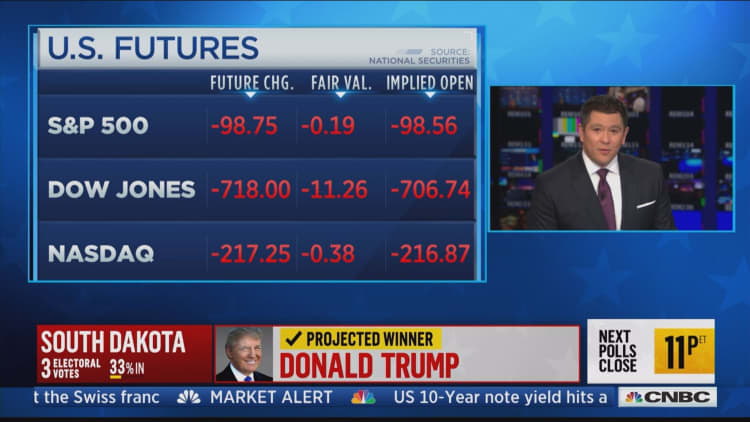

Wall Street was caught flat-footed overnight as Donald Trump won the presidency, a result few strategists, investors and economists took seriously in their preparation for the election.

Traders clamored into safe havens such as gold and U.S. Treasurys, but many simply did not know what they would do when trading opened Wednesday, because of the uncertainty about the New York businessman's policies.

"I don't see money stepping into stocks. I think money is going to be scared. Unless you get a 10 percent sell-off, I don't see it ending," said Stephen Weiss, chief investment officer at Short Hills Capital Partners. "I don't think anybody's got a real plan."

None of the major Wall Street investment banks predicted a Trump win. He was "tail risk," mostly relegated to the end of lengthy reports to clients filled with tips on how to invest around a Hillary Clinton victory.

For a Trump win, "our base case is for incremental downside of 5-10 percent from the Nov 7th close, but a case can be made for a decline in the low to mid teens," said a report this week from Credit Suisse U.S. equity strategist Lori Calvasina, who to her credit devoted an equal amount of analysis to a Trump victory.

One hedge fund manager who did not want to be identified said he knew of multiple calls that took place Tuesday night between risk managers and their portfolio managers about what could be done in the overnight markets to lessen the pain at the open Wednesday morning. Most investors were positioned for a Clinton win and a continued rally in stocks, the manager said.

To be fair to Wall Street, one of the reasons why Trump did not garner as much attention in these client reports was because of a lack of clarity about his positions. Tuesday night, it was just that uncertainty about Trump's policies that sent markets spiraling.

"The positives of a Trump win are corporate tax reform, but the negatives are protectionism, and that is a really big thing," said Brian Kelly of Brian Kelly Capital. "More importantly what's he going to do with the Federal Reserve."

Kelly said he was likely to stick to macro-economic trades Wednesday and buy some gold. He said the "buy-the-dip" playbook of the equity bull market is likely out the window Wednesday for him and most traders.

On Wednesday "you got to let the market wash itself out. Maybe take a shot [at some stocks], but have to see how this washes out. The stocks to buy would be fiscal stimulus plays, the infrastructure plays, the GEs," Kelly said.

Trump has been critical of Federal Reserve chair Janet Yellen, whom he accused of being politically motivated and keeping rates artificially low for too long. That seemed to be the issue spooking traders the most on Tuesday evening. The easy money policies of Yellen and her predecessor, Ben Bernanke, have been seen as key to lifting asset prices, even though it was expected that the central bank may nudge rates higher in December.

"The dollar gets slammed in a sea of global uncertainty, and the chances of a Fed rate hike in December head towards 0 percent" in a Trump win, Larry McDonald wrote Tuesday morning in his Bear Traps Report, where he warned Wall Street was underplaying the Trump risk.

"Gold's best outcome is a Trump win, as political uncertainty will lead to economic and financial volatility in a hurry, and recession risk surges. Before the Donald is inaugurated," McDonald said, "gold will rise to $1400."