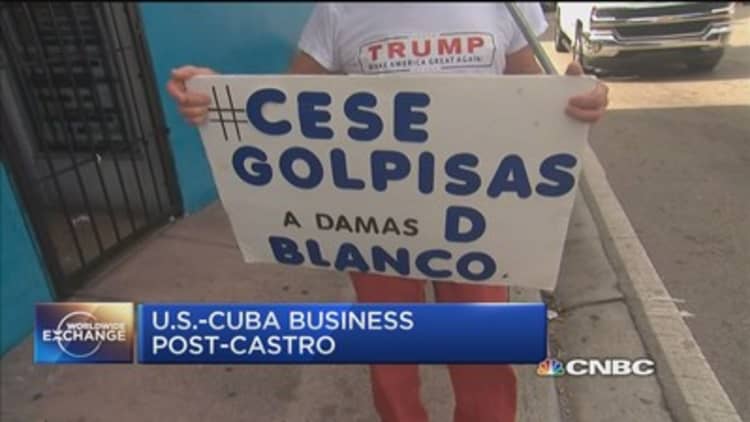

In the wake of Fidel Castro's death all eyes are on what the future holds for the Cuban economy. The hope is another revolution will be sparked: a push by the populace for a more open market economy. President Obama's agreement to normalize relations with the communist island nation has proved to be a catalyst for change. It remains to be seen if the Trump administration will continue to maintain detente with Cuba, or reverse course.

Today, President-elect Donald Trump threatened in a tweet that he would terminate the deal that reopened Cuban-American relations if Havana—known for human rights violations— is unwilling to negotiate a better agreement for its citizens, Cuban Americans and the U.S. as a whole.

Already in the investing landscape of least-traveled markets, Cuba is gaining traction. As the economy liberalizes gradually, more Cubans have access to private income that supplements low-paying government jobs. Remittances are also rising and forecast to expand further. The net effect is more affluent Cuban consumers with more purchasing power than ever before.

There are still many Cubans who are getting by, driving around decades-old cars. But there are pockets of new money, too. "You do see people in Cuba driving around in nice cars and with designer handbags," said Marguerite Fitzgerald, partner and managing director at The Boston Consulting Group's Miami office. "They do have income."

For now Cuba's wealthier residents are only a small portion of the island's 11 million, and concentrated in urban areas, Fitzgerald notes. But the trend is expected to spread. And according to BCG's forecasts, those incremental wealth gains will generate market opportunities for consumer goods companies over the next five to 10 years.

Often through word-of-mouth recommendations from friends and relatives in Miami, select brands have already established a foothold in the Cuban market. One example is BLU Products, a Miami-based maker of affordable, unlocked mobile phones.

In March, President Barack Obama made his historic visit to Cuba. He was the first sitting U.S. president to do so in nearly 90 years. And many Cubans captured the moment with mobile phones — including BLU.

"Once you have a good product with a good design, people will talk about it and recommend it," said Samuel Ohev-Zion, chief executive of BLU.

A key driver of rising incomes in Cuba is remittances, or money transfers by foreigners to their home countries. Roughly 40 percent of Cubans living in Havana pocket remittances. This money flow to Cuba grew by 15 percent annually from 2010 through 2014 to about $3 billion, according to BCG's estimates. Driving the growth of remittances are more Cubans living in the U.S., and raised caps on remittances.

This influx of money transfers will only grow. Remittances could reach $6 billion by 2020, according to BCG. As a point of reference, Cuba's net exports in 2014 were estimated at less than $4 billion.

More remittances have a big impact on wealth gains among Cubans, especially when you consider how much Cubans earn from government jobs. Many Cubans take home state salaries, typically $20 to $25 a month. More than 75 percent of Cuban households earn less than $1,000 annually.

Cuba's GDP per capita exceeds $5,300, according to the World Bank. But because the government subsidizes the purchase of basic food and offers free education and health care, extra income added to state salaries including remittances essentially becomes discretionary spending for non-basic goods such as luxury items.

"So really this [remittances] becomes discretionary income," said Fitzgerald of BCG.

And the more money Cuban consumers have to spend is a potential market opportunity for consumer-facing companies — including those beyond tourism as travel restrictions have loosened. Earlier this year, the Obama administration unveiled new measures to make it easier for Americans to visit Cuba.

Entrepreneurship rising

Another key source of rising private income in Cuba is more small-scale entrepreneurship. In 2010, Cuba launched a series of market-based reforms including easing some rules on self-employment and private ownership. Previously Cubans could own private businesses only in service professions such as restaurant owners, hairdressers and tour guides, and couldn't have any employees. The changes now allow entrepreneurs – or cuentapropistas – to hire up to 25 workers. The reforms also expanded the variety of professions open to entrepreneurship to include carpenters, computer repairers and music teachers. And the number of cuentapropistas has increased.

"You'll find doctors, highly qualified doctors with PhDs, and engineers driving taxis," Fitzgerald said.

To offer some context, an entrepreneurial cab driver — escorting a tourist around the island for several days — can earn several hundred dollars. That's a huge income addition to their state salary that likely pays up to $25 a month.

With earning potential opening up, the number of self-employed Cubans has grown to 483,000 in 2014 from around 157,000 in 2010, when the new regulations kicked in, according to the Lexington Institute and BCG data.

"There is areal growing gap between the haves and have-nots," Fitzgerald said.

Cuba is a closed community. So if someone is enjoying a product, people are going to know about it.Ohev-ZionCEO of BLU Products

Of course there are uncertainties facing Cuba including demographic trends. Amid falling birth rates and rising emigration to the U.S. and other countries, Cuba has the oldest population in Latin America with a median age of around 38 years. And that's a potential risk for foreign companies as younger consumers tend to spend more on discretionary goods.

More from Global Investing Hot Spots:

Not Trump. Not the Fed. Populism is the gravest threat to the market.

The Brazilian stock market is on a tear this year

The hottest spot on earth has a melting economy

Another hurdle is government control over foreign enterprises. State retains control over products sold, and how they'll be distributed among retail channels and markets. The government sets nationwide pricing, which means foreign companies can't stimulate sales through promotions.

In many cases, a foreign investor needs to partner with some pocket of the Cuban government. Despite such caveats, Cuba actively has courted other countries to expand trade. China, for example, has made significant investments in Cuba's infrastructure. Many of the new buses on the island were manufactured in China.

Other Cuba watchers warn against placing too much emphasis on micro entrepreneurship activities that rarely result in exported goods. "None of these activities are designed to earn foreign currencies," said Jose Azel, a Cuba researcher at the University of Miami. "The country can only develop if it can export and earn foreign currencies."

Despite such obstacles, select companies have already used unconventional routes to access Cuban consumers. Dutch brewing giant Heineken, for example, brought refrigerated trucks to the island and handed them to Cuba's Ministry of Trade, essentially ceding control of distribution, according to BCG. Heineken's existing brand presence on the island could expand further as Cuba's economy opens up.

Heineken holds a large scale presence in Latin America including Cuba, says Heineken spokesman Bjorn Trowery. "Heineken is continuously looking to expand into different markets as appropriate for the company and for the region," said Trowery in an emailed statement. He did not offer additional details on Heineken's Cuba strategy.

And many foreign companies connect with Cuban consumers through word-of-mouth recommendations and networks in Miami. People in Cuba also gain knowledge through packets or El Paquetes. Though illegal, an underground network in Cuba distributes the USB thumb drives, chock full of everything from U.S. TV shows and movies to a spreadsheet of consumer goods available for sale, roughly analogous to Craigslist.

Without being marketed to directly, Cuban consumers already show high brand awareness for a variety of products including electronics, apparel and mobile phones. While the Cuban government bans all direct advertising or marketing to consumers, except for store displays, word travels to and from Miami and Cuba.

Based on a BCG survey of Cuban consumers in 2015, brands have begun to establish a foothold in Cuba.

- Electronics names cited among Cuban consumers were: Haier, LG, Sony, Daytron and Panasonic.

- Apparel brands mentioned were Nike, Puma, Lacoste, Zara and Adidas. Fidel Castro has an affinity for Adidas tracksuits and has worn them for meetings with foreign dignitaries.

- Mobile phone brands cited were Alcatel, Samsung, Nokia, LG and BLU.

How one company conquered Cuba

One company that's cracked the Cuban consumer market is BLU Products. Soon after the company's founding in 2009, BLU learned through its customers that its mobile phones were making its way from Miami into Cuba through friends and relatives.

A mobile phone entrepreneur for nearly 20 years, BLU Products CEO Ohev-Zion, originally from Brazil, spotted the potential of entry-level phones. After distributing other mobile phones including Samsung in Miami and Latin America, Ohev-Zion launched BLU to make and distribute their own independent line.

From its Miami headquarters, BLU targets the U.S. and Latin America. The bulk of BLU's colorful mobile phones retail for around $49 to $149 and are unlocked devices, not tethered to a carrier plan. Miami area customers snatched them up, then passed along the phones to friends and family back in Cuba as part of remittances.

Pinpointing how much Cuba contributes to BLU's overall business is tricky. It's difficult to track phones that eventually are transferred to owners outside the U.S., CEO Ohev-Zion explained.

Overall, BLU is expected to sell about 15 million devices in 2016. Sales are split between domestic and international. And roughly 90 percent of BLU's international sales are in Latin America — including Cuba.

BLU has never advertised in Cuba, and the company has had no direct dealings with the Cuban government. Brand traction on the island continues to flourish through informal channels and word of mouth.

"Cuba is a closed community," said BLU CEO Ohev-Zion. "So if someone is enjoying a product, people are going to know about it."

In many ways, the island is like a white space, waiting for consumer companies to make a firmer impression as private incomes rise and affluent consumers increase.

"You still have to work with the Cuban system," said Fitzgerald of BCG. "But there is a consumer market there. And it is growing."

— By Heesun Wee, special to CNBC.com