Despite oil's negative reaction to the OPEC production cut extension, prices should grind higher into the $60s by the fourth quarter, RBC's Helima Croft told CNBC on Thursday.

Prices plunged after OPEC and other major exporters extended their deal to limit oil production for nine months, disappointing investors who were anticipating deeper output cuts.

Brent crude oil dropped 5 percent, or $2.70, to $51.44 a barrel by 3:06 p.m. ET. U.S. West Texas Intermediate (WTI) crude futures ended Thursday's session down 4.8 percent, or $2.46, to $48.90.

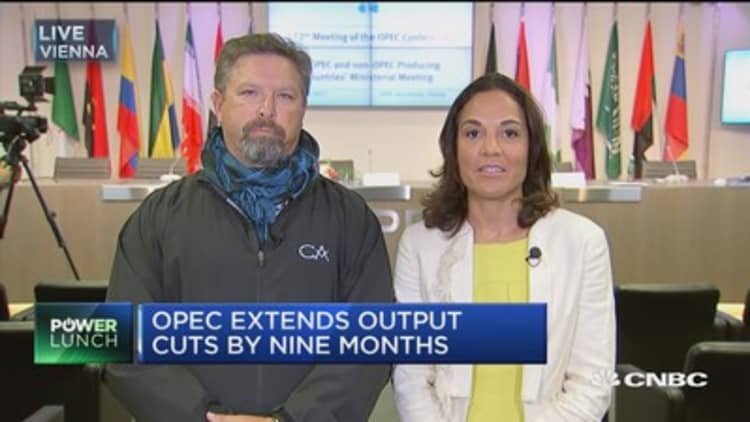

Croft, global head of commodity strategy at RBC Capital Markets, said the extension was a forgone conclusion, but getting a deeper production cut would have been a challenge.

She believes continuing the current deal works with the policy priorities of Saudi Arabia, which is focused on the Aramco IPO, and Russia, where President Vladimir Putin is concerned about keeping the Russian population happy and social spending continuing heading into the presidential election next March.

"It's a combination of political and economic priorities coinciding with wanting to have a better technical fundamental outlook for oil," Croft said in an interview with "Power Lunch."

She sees the floor in oil in the $50s for the last half of the year, with WTI averaging $61 in the fourth quarter.

Mike Rothman, head of integrated oil research at Cornerstone Analytics, is also convinced prices will ultimately move higher despite supply coming from the U.S., Libya and Iraq.

"When you put everything together, the fact is OPEC's taking a million and a half a day out of supply from the market since November. That's 45 million barrels a month," he told "Power Lunch."

"That to me looks like that's enough to swing the balance and get us into a much lower inventory level later in 2017."

OPEC announced the agreement to cut oil production in November, but surging U.S. output, weak fuel demand and persistently robust OPEC exports in the first half of the year offset those reductions.

— CNBC's Tom DiChristopher, Matt Clinch and Jackie O'Sullivan contributed to this report.