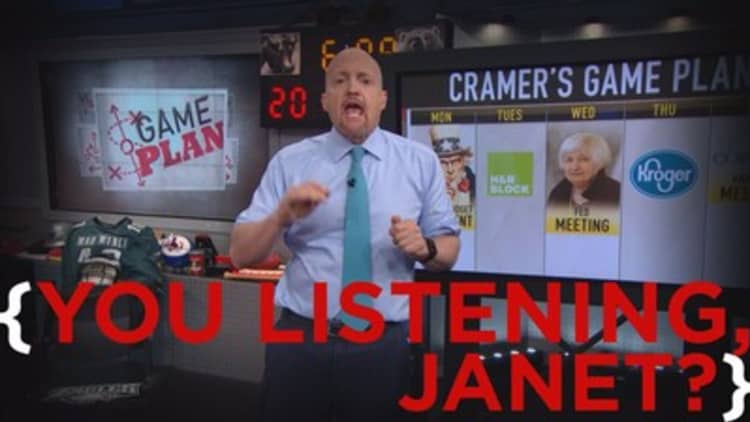

For Jim Cramer, Wednesday is the most important day of next week for one reason: a Federal Reserve meeting in which the central bank could raise interest rates, which would be a boon to the bank stocks.

"It's vital, after day two of this bank stock rally that we had [Friday], that the Fed not only raise rates, but say it will continue to raise rates and leave the door open firmly for another rate hike this year," the "Mad Money" host said. "If the Fed waffles, then the rotation to the banks ends immediately and the money could veer back to the techs."

But if the Fed comes out optimistic about its interest rate agenda, Cramer expects the bank rally to continue, though if it does, the top financials could become overextended by the week's end.

So with today's market rotation expected to continue in the near term, providing a buying opportunity for some of the top growth names, Cramer's game plan for next week involves keeping an eye on taxes, earnings, and a company that could give investors a clue about Apple.

Cramer also spoke with Paul Szurek, the president and CEO of data center giant CoreSite Realty, to hear more about the fast-growing sector and how companies like Nvidia are driving innovation.

"As processing power has become more efficient [and] therefore less costly, it has enabled more use cases for data, and as a result, the demand has continued to exceed the improvements in processing power," Szurek told Cramer on Friday, referencing Nvidia's ever-strengthening chips.

And while companies like CoreSite put high priority on improving power efficiency and cooling the units they house, semiconductor companies are forging ahead with their missions as data centers rush to keep up.

"There are some things on the horizon that require, probably, this kind of processing power to really go commercial in a big way – you know, autonomous driving vehicles, internet of things, artificial intelligence, and a lot of the really cutting-edge data analytics that I think we'll see over the next five, 10, 15 years," Szurek said.

In the meantime, with Wall Street analysts in a frenzy over the stock of market favorite Nvidia, Cramer finds the buzz around the chipmaker's stock to be almost cartoonish.

"You see, even after today's hideous 6.5 percent pullback, I think the stock of Nvidia, by its sheer upward momentum, has become a self-fulfilling prophecy," the "Mad Money" host said. "Analysts have price targets for stocks, and with each giant step forward, this stock overruns those levels that analysts were expecting, so then they have to get on the horn — meaning speak to the sales force — and raise their price targets again, usually giving a whole new set of reasons for their comments so as not to be seen as merely playing the momentum game, which, after all, is exactly what they're playing."

However, Cramer certainly sees weight to their arguments. It goes without saying that he likes the company, whose stock has been the top performer in the market over the past year.

Turning to a not-so-hot stock as President Donald Trump's "Infrastructure Week" comes to a close, Cramer decided to take a closer look at one perceived Trump play that has been struggling of late.

"What in the world is going on with Chicago Bridge & Iron, CBI, the once-great industrial that's seen its stock get cut almost in half so far this year, including a 15 percent decline this week alone?" the "Mad Money" host asked. "Back in November, Chicago Bridge & Iron was seen as a quintessential Trump stock, the kind of company that could benefit from the president's infrastructure agenda and his embrace of domestic fossil fuel production."

Cramer attributed the stock's weakness mainly to declining oil and natural gas prices, which fell off a cliff in 2014, but said some of CB&I's company-specific missteps may have cost it more than the downturns in oil prices.

Idexx Laboratories: Pet Love = Stock Love

Finally, Cramer turned to Idexx Laboratories, a company that develops diagnostic systems for pets when they go to the veterinarian — and has a stock that is up 40 percent for 2017.

"This is a company that's been innovating almost constantly for the last 20 years, coming up with better and better vet systems. Over the last five years, Idexx has generated 80 percent of the entire industry's investment on new product innovation within the animal diagnostics category," Cramer said.

A name that fits snugly in to Cramer's "humanization of pets" thesis — which states that as more people in the United States buy cats and dogs, those animals are treated more like members of the family and thus more money is spent on them — Idexx is a strong player in the veterinary space with solid prospects for the future.

In a class above its competitors, Idexx's stock is expensive compared to the rest, so Cramer advised waiting for a pullback to buy the stock for investors who do not already own it.

"But given Idexx's track record, you might be waiting for a very long time or you'll only have a small window of opportunity," he said.

Lightning Round: An Unexpected Raid

Mazor Robotics: "You know what, the Tel Aviv authorities raided the company. It's been now down 10 [basis] points. The company has not indicated what's wrong and doesn't seem to know, and the Tel Aviv authorities haven't told us. I'm reluctant to say 'Hey, listen, don't worry about it' because I don't know what the cause of the investigation is. We have to wait, and they have to come back on and tell us, and we'll welcome them on the show."

Tiffany & Co.: "You know, I think Tiffany's OK. I didn't like the last quarter, but the fact is the stock didn't go down after they reported, which tells me that you are OK to own Tiffany."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com