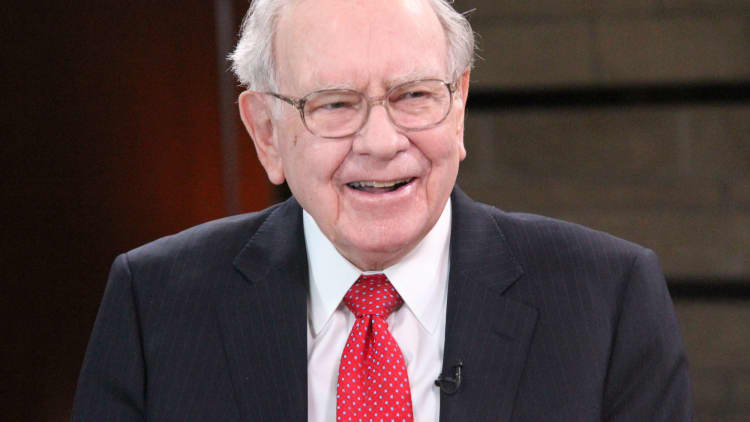

Warren Buffett's Berkshire Hathaway said it would exercise its warrants to buy 700 million common shares of Bank of America, making it the largest shareholder of the lender.

Berkshire said it would exercise its warrants after the bank raises its quarterly dividend to 12 cents per common share.

The conglomerate said it expected to use $5 billion of Bank of America's 6 percent preferred stock that it currently owns to fund the acquisition.

Buffett had bought $5 billion of Bank of America preferred stock with a 6 percent dividend, or $300 million annually, in August 2011, when investors worried about the bank's capital needs.

The purchase included warrants to acquire 700 million common shares at $7.14 each, less than one-third Thursday's closing price of $24.32.

At Bank of America's current share price, the stake would hand Berkshire a $11.7 billion profit, at least on paper.

Bank of America on Wednesday boosted its annual dividend to 48 cents per share from 30 cents, beginning in the third quarter. The dividend increase was approved by the Federal Reserve, which conducts annual "stress tests" of big banks' ability to handle tough

economic and market conditions.

The second-largest U.S. bank also announced a $12 billion stock buyback plan.

Vanguard Group, which is currently BofA's biggest shareholder, holds 6.6 percent stake, or about 652 million shares in the company.

WATCH: How Warren Buffett makes long-term investments

—CNBC contributed to this report.