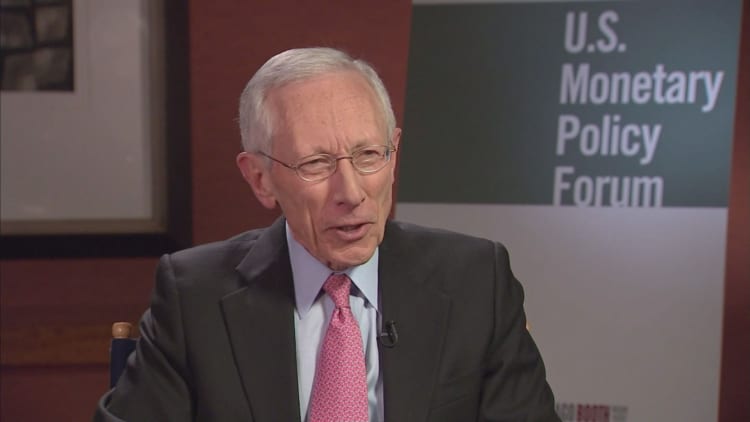

Stanley Fischer's surprise decision Wednesday to step down from the Federal Reserve is part of a new era for the central bank that increasingly looks like it won't include Chair Janet Yellen, Fed watchers said.

Citing personal reasons, Fischer said his last day will be Oct. 13, eight months before his term actually expires.

Along with creating another void on the Federal Open Market Committee as well as the Board of Governors that helps set regulatory policy, the resignation gives President Donald Trump another opportunity to recreate the Fed in an image closer to his own beliefs.

Over the course of the next several months, the central bank probably will look quite a bit different than it does now.

"People who thought we were going to keep the same cast of characters around, I hope they realize now that's not the case. There's going to be a significant change," said Christopher Whalen, a former investment banker and head of Whalen Global Advisors. "It will be far less interventionist, far less prone to experiment."

Indeed, the Yellen-Fischer Fed will go down as perhaps the most activist central bank in history. Though they differed on some details about policy, they always voted together on Fed policy statements and were seen as closely aligned ideologically.

Responding to the economic downturn during the financial crisis, the Fed took its benchmark rate target to near zero and embarked on three rounds of bond purchases, known as quantitative easing, that saw its holdings zoom to $4.5 trillion.

In addition to the aggressive monetary policy, the Fed also became a tough regulator, pushing banks to increase their capital buffers to prevent another liquidity crisis from happening.

Looking ahead and judging by Trump's public comments, he's likely to favor a Fed that continues to back low interest rates and a weak dollar. Where the appointees likely will diverge, then, from the Yellen Fed is where they stand on regulations.

"Monetary policy is going to be data dependent. If that's true perhaps the more intriguing angle is regulatory policy," said Greg Valliere, chief global strategist at Horizon Investments. "That may guide his thinking on the next chairman."

Trump ultimately will get the chance to appoint four or five new members by early 2018 — he already has nominated Randal Quarles, who favors a lighter regulatory touch, for one spot. Should anti-regulation become a prerequisite, it could make things uncomfortable for the pro-regulation Yellen.

During a recent speech at the Fed's annual Jackson Hole, Wyoming, summit, Yellen made remarks stressing the importance of banking safeguards that many saw as thinly veiled jabs at the president.

Most Fed experts believe the Fischer resignation signaled at least a marginally weaker chance that Yellen will be sticking around.

"She's 71, and she's got a choice of maybe slowing down her pace and writing a book, or presiding over the winding down of the balance sheet with a big group of Trump appointees at the Fed," Valliere said. "She may choose the former rather than the latter."

Online prediction markets continue to reduce the likelihood that Yellen will be reappointed or stay. PredictIt most recently has Trump economic advisor Gary Cohn as the favorite, with a 25 percent chance, while Yellen is at 18 percent. Former Fed Governor Kevin Warsh is close behind at 17 percent.

Krishna Guha, economist at Evercore ISI, puts the chances of Yellen staying on even lower.

Fischer's "early departure meanwhile will rob the next Fed chair of a hugely respected and experienced number two who might otherwise have served as consigliere to a new Fed chair in the early months of his or her term and helped smooth the transition in the base case in which Yellen is not appointed to a second term (we put Yellen reappointment at roughly 20 per cent)," Guha said in a note.

How quickly Trump makes his decision on Yellen as well as the existing Fed vacancies is another question. The president has been slow thus far with his appointments overall, so the central bank may well be down a few members for quite a while.

"The nomination and confirmation process can be quite slow," Seth Carpenter, an economist at UBS, said in a note. "Given the full slate of issues that the Congress has to confront (the debt limit, the budget, tax reform, inter alia) the Senate will be hard pressed to complete more than one confirmation process."

WATCH: This market pro believes Yellen will stay.