President Donald Trump on Wednesday promised that his newly released tax reform plan would deliver American businesses and families some of the lowest tax rates in nearly a century, and do so with bipartisan support in Congress.

"Tax reform will protect low-income and middle-income households, not the wealthy. They can call me all they want. I'm doing the right thing, and it is not good for me. Believe me, it's not. "What IS good for me, is if everything takes off like a rocket ship."

"This will be the lowest top marginal income tax rate for small and midsize businesses in more than 80 years," Trump said at a tax reform event in Indianapolis, just hours after the release of a much anticipated joint tax reform plan crafted by the White House and congressional tax writing committees.

"Under our framework, we will dramatically cut the business tax rate so that American companies and American workers can beat our foreign competitors and start winning again," he said.

A proposed 20 percent corporate tax rate, Trump said, would put U.S. business tax rates below the average of other industrialized nations, which the president called "a revolutionary change."

Business groups seemed to agree. The nonprofit RATE Coalition, which advocates for lower corporate taxes, called the GOP tax framework "a once-in-a-generation opportunity to do right by American workers."

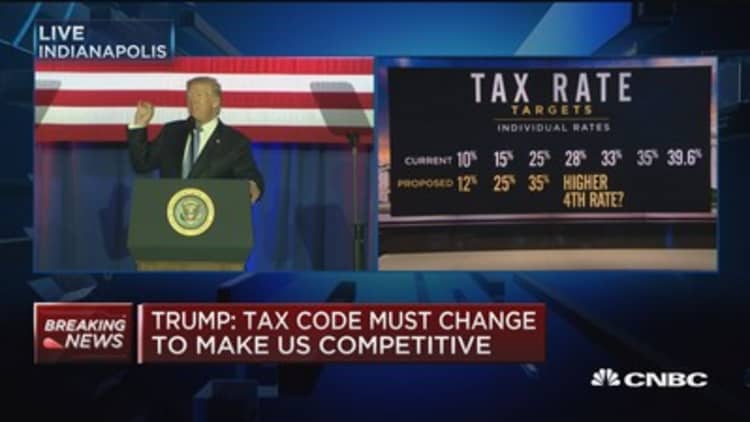

The Republican plan that was unveiled Wednesday contains sweeping income tax cuts for both individuals and businesses, but few details on how the government might pay for them. It also contains a number of provisions that would benefit the wealthiest Americans.

Nonetheless, Trump assured the audience that the biggest winners in the GOP plan would be low-income and middle-income taxpayers.

Another theme of the speech was bipartisanship, which Trump underscored by inviting Sen. Joe Donnelly, D-Ind., to be his guest aboard Air Force One for the flight from Washington, D.C.

"Tax reform has not historically been a partisan issue — and it does not have to be a partisan issue today," he said. "There is no reason that Democrats and Republicans in Congress should not come together to deliver this giant win for the American people and begin the 'middle class miracle' once again."

Donnelly, a moderate Democrat facing a difficult re-election campaign in 2018, has said he's open to working with the Trump administration on tax reform.

"I really believe we're going to have numerous Democrats come over and sign" the eventual tax reform bill, Trump said.

Still, the speech was uncharacteristically subdued for Trump, who typically feeds off the energy of his crowds. The only times that Trump seemed animated during Wednesday's address were when he was describing how much he hated certain taxes.

"We are finally ending the crushing, horrible unfair disaster that is the estate tax," he said at one point, referring to a tax that only around one-fifth of 1 percent of Americans are wealthy enough to incur.

Trump and his family, however, are among that tiny percentage.

WATCH: Trump says he won't benefit from tax reform