The White House believes economic growth will cancel out the likely deficit created by proposed Republican tax cuts.

But in the congressional rules process, the growth effects may not matter. Lawmakers may have to choose between either finding a way to cut taxes without blowing up the deficit long term or passing only temporary tax changes.

That could create some headaches for the GOP as it looks to fundamentally overhaul the U.S. tax system this year.

Republicans will likely aim to pass a tax bill with only GOP votes. To do so, they will use budget reconciliation rules, which require only a majority vote rather than the 60 votes needed to overcome a filibuster in the Senate.

The GOP released a tax plan framework Wednesday calling for chopping rates for individuals and businesses while broadening the tax base and scrapping many deductions. But the plan seems likely to increase the U.S. deficit significantly before taking into account economic growth, or so-called dynamic scoring.

Under reconciliation rules, a bill cannot increase the long-term deficit beyond a predetermined level. The official assessment of the bill's budget effects will use static scoring, which does not account for growth estimates, according to Ed Lorenzen, senior advisor for the Committee for a Responsible Federal Budget, a nonpartisan group that analyzes fiscal policy.

That will almost certainly lead to an estimated deficit over the long term higher than the GOP would like, as the plan currently stands. Without figuring out how to keep the deficit down, Republicans could be forced to change the tax system for a shorter period of time than they would like.

On Thursday, House Speaker Paul Ryan said he wants the tax bill to be deficit neutral but did not say how lawmakers would accomplish the goal. He cited the Byrd rule, which requires 60 votes in the Senate for a bill that increases the deficit after the period covered by the budget resolution.

"In order to comply with the Byrd rule it has to be deficit neutral in the out years," Ryan told reporters. When asked how that would happen, he responded, "we'll see."

Where the process goes from here

Starting next week, Republicans are moving to pass a fiscal 2018 budget resolution. The House has a floor vote on the budget planned for Thursday.

In that bill, the GOP will set out so-called reconciliation instructions, including the amount a bill passed through reconciliation can add to the deficit during a specific period of time.

Senate Republicans have reportedly agreed that a tax plan can add $1.5 trillion to the deficit over 10 years, according to The New York Times. That figure may fall after negotiations with the more fiscally conservative House, Lorenzen said.

The House Budget Committee has already approved a budget resolution calling for deficit neutral tax reform. It calls for major spending cuts, a controversial push that could still pass the House.

When the chambers agree on and pass a budget resolution, they can move forward with a tax bill. The potential deficit issues would come into play then.

The framework released by Republicans on Wednesday is an outline missing many key details. The relevant congressional panels — the House Ways and Means Committee and Senate Finance Committee — could make major changes to the plan as they write a bill.

As it stands now, Republicans may need to make changes to avoid a major deficit increase. The CRFB estimates the tax framework would add $2.2 trillion to the deficit over a decade, well over the $1.5 trillion target. Lorenzen cautions that the estimate could change as more details emerge about a potential bill.

Some Republicans, including President Donald Trump's top economic advisor, Gary Cohn, argue the economic growth generated by the plan will cancel out the lost tax revenue. Better economic output will lead to more tax revenue, proponents of dynamic scoring argue.

"We think we can drive a lot of business back to America, we can drive jobs back to America, we can make ourselves very competitive," Cohn told CNBC on Thursday morning. "We think we can pay for the entire tax cut through growth over the cycle."

But for the purpose of congressional rules, growth will not matter in deficit calculations, Lorenzen said.

Republicans have options if it looks like their plan will increase the deficit by too much. They can reduce the amount by which they chop tax rates or close more loopholes to cancel out the cuts.

However, Republican leaders appear set on keeping in place the 20 percent corporate tax rate and changes to individual rates proposed on Wednesday.

Lawmakers could also choose to "sunset" some provisions, meaning they go away after a set period of time and stop adding to the deficit. For instance, the framework proposes an "expensing" provision to allow businesses to write off their capital expenses, which lasts only five years.

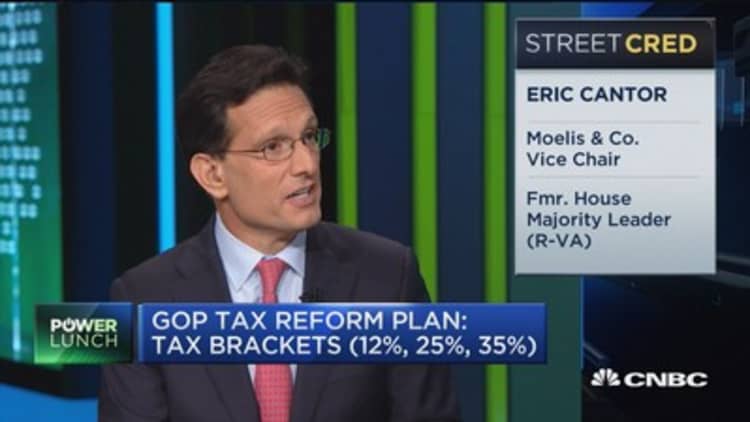

WATCH: Tax cuts the tail wagging the dog