Tax reform, we have a problem.

President Donald Trump and the Republican Congress are betting their 2018 electoral fortunes on getting a big tax bill signed into law by the end of the year. Without it, the GOP will be zero-for-two on big-ticket items following the Obamacare repeal failure.

But significant problems are already emerging that could turn their hopes into disaster — or at least into a much less ambitious, temporary tax cut bill.

The problems begin with Senate Republicans, who also torched Obamacare repeal. Last week, Sen. Bob Corker, the Tennessee Republican now unchained from political considerations after announcing he won't run again, said he would not vote for a bill that significantly adds to the deficit. "With realistic growth projections, it cannot produce a deficit," Corker said. "There is no way in hell I'm voting for it."

That "realistic growth projections" line is key.

Treasury Secretary Steven Mnuchin argues that robust growth fueled by tax cuts will actually pay down the national debt by $1 trillion. But that assertion is backed up by no serious data. The nonpartisan Tax Policy Center puts revenue lost from the blueprint at $5.6 trillion over 20 years.

Unidentified deduction cuts and faster growth could make up some but not nearly all of that gap. One of the tools the administration is considering to make up for lost revenue is eliminating the state and local tax deduction, but that's already in big trouble and could get killed on the Hill.

Other senior administration officials are not taking up Mnuchin's line, instead junking years of warnings on the debt and deficit and deciding to embrace unfunded tax cuts and bigger deficits as the price of getting faster growth.

OMB Director Mick Mulvaney, for years a fierce deficit hawk in the House who demanded dramatic budget cuts in return for raising the debt limit, is now singing from the hymnal of supply-side tax cutters who don't care about deficits. "I've been very candid about this. We need to have new deficits because of that. We need to have the growth," Mulvaney said on CNN on Sunday. "If we simply look at this as being deficit-neutral, you're never going to get the type of tax reform and tax reductions that you need to get to sustain 3 percent economic growth."

But the problems are not limited to concerns over the deficit. Sen. Rand Paul, R-Ky., among those who helped kill Obamacare repeal efforts, sent a sharp warning shot over the tax blueprint on Twitter this week, citing the Tax Foundation study.

The problem here is that, based on any analysis, the biggest tax breaks in the GOP blueprint go to top earners, including Trump himself, through a reduction in the top personal rate, the elimination of the alternative minimum tax and the estate tax, and a reduction in the top rate on "pass-through" business income to 25 percent from 39.6 percent.

The White House argues that slashing the corporate rate to 20 percent from 35 percent will unleash companies to create more and better-paying jobs and stay in the United States rather than incorporating in tax havens. It might in fact do some of this.

But it is not a direct cut in middle-income taxes.

The fact that Treasury felt the need to censor a 2012 report from its own Office of Tax Analysis showing that workers pay just 18 percent of the corporate rate while owners of capital pay 82 percent shows just how sensitive the administration is to criticism of slashing the corporate rate while offering middle-income earners either small or no tax cuts.

There is also the problem of needing to get a budget through both chambers that would include reconciliation instructions that would allow a tax plan to clear the Senate with just 51 Republican votes. Currently, the Senate budget blueprint would allow a tax cut bill to add $1.5 trillion to the deficit over 10 years, which is at this moment much less than the GOP blueprint would actually add.

But on the House side, the budget plan would not allow tax cuts to add to the budget deficit at all. Somehow these differences need to be bridged over the next few weeks before Republicans can even begin to put together an actual tax reform bill.

And as soon as that bill is released, if it identifies deductions to cut including state and local and corporate interest, lobbyists will swarm to try and save those deductions. If they succeed, the cost of the tax bill will go up again and make it impossible to make any of the cuts permanent and still comply with reconciliation instructions.

And all of this leads back to the possibility of scaled back and temporary tax cuts. If the GOP can't find agreement on a plan that does not add to deficits over 10 years based on a realistic budget score, then they will have to sunset cuts to corporate and individual rates, making any bill similar to the temporary cuts enacted under President George W. Bush.

This should be theoretically easy to do. But what if Republican senators like Rand Paul and Bob Corker balk at this, arguing that there is no real evidence the economy needs a bunch of unfunded and temporary tax cuts right now, especially if the direct benefits to the middle class are limited? And most big American businesses are highly critical of the idea of temporary rate cuts because you can't plan around them.

All of the problems with the GOP tax blueprint trace back to an existential issue. This initially began as an exercise in doing fundamental corporate tax reform that stripped out loopholes and deductions to lower the rate and broaden the base and make the U.S. more globally competitive.

But it is now a Frankenstein's monster of corporate and individual cuts with very limited base broadening. And this monster could expose all kinds of fissures in the GOP and wind up eating the party's chances of getting anything significant done this year.

— Ben White is Politico's chief economic correspondent and a CNBC contributor. He also authors the daily tip sheet Politico Morning Money. Follow him on Twitter @morningmoneyben.

CORRECTION: The nonpartisan Tax Policy Center weighed in on the Republican tax reform blueprint. The organization's name was misstated in an earlier version of this article.

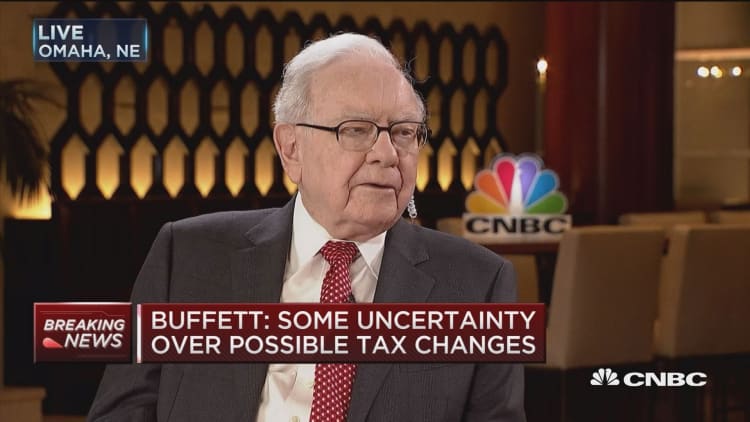

WATCH: New tax plan rally red flag