Gold fell for a third straight session on Wednesday on pressure from the U.S. dollar's gains for much of the session and amid speculation that the next chair of the Federal Reserve could be a policy hawk.

Spot gold was down 0.34 percent at $1,280.40 an ounce by 3:12 p.m. ET, having touched its lowest since Oct. 9 at $1,276.73.

U.S. gold futures for December delivery settled down $3.20 or 0.25 percent, at $1,283 per ounce.

As many as five people are in the running to be the next Fed chair, a source told Reuters on Tuesday.

"Interest rate hikes had not been fully priced in for next year. That has changed massively following speculation that (Fed Governor Jerome) Powell might become the next chairman," said Commerzbank analyst Carsten Fritsch.

Powell is expected to be the next Fed chairman, according to a slim majority of economists in a Reuters poll, though most of them said that incumbent Janet Yellen would be the best option.

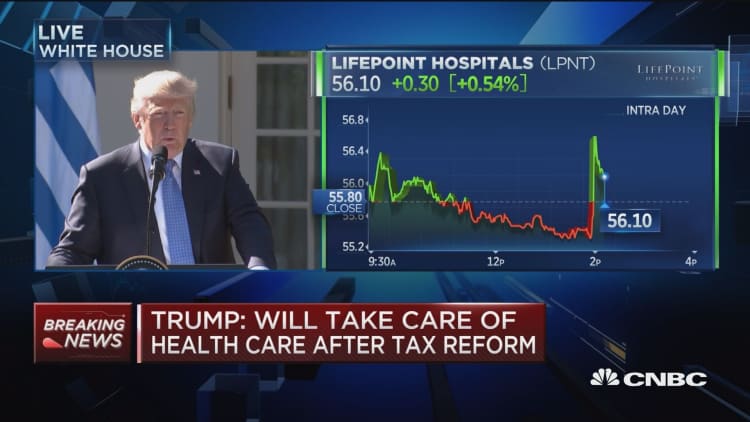

The dollar rose to a 1-1/2-week high before turning lower as traders digested more details on U.S. President Donald Trump's tax overhaul.

The U.S. economy expanded at a modest to moderate pace in September through early October despite the impact of hurricanes on some regions, the Federal Reserve said in its latest snapshot of the U.S. economy released on Wednesday, but there were still few signs of an acceleration in inflation.

"Despite widespread labor tightness, the majority of districts reported only modest to moderate wage pressures," the U.S. central bank said in its Beige Book report of the economy, derived from talking to business contacts across the country.

U.S. tax reform is expected to stimulate economic growth and inflation, as is therefore seen as negative for gold.

The Fed meanwhile is widely expected to raise interest rates for the third time this year in December.

Gold is highly sensitive to rising U.S. interest rates, which increase the opportunity cost of holding non-yielding bullion while boosting the dollar, in which it is priced.

"With dollar strength in mind, it would present further risks to gold, but I'm waiting to see how the Catalonia crisis unfolds tomorrow, pinpointing a possible next move for gold, in either direction," said Jameel Ahmad, vice president of market research at FXTM.

Gold is often used as a store of wealth in times of political or economic uncertainty.

"The key support level for gold is $1,275 ... and $1,260 (per ounce) more importantly," said Bill O'Neill, partner at Logic Advisors in Upper Saddle River, New Jersey, referring to the 100-day moving average and an October low.

In other precious metals, silver was flat at $17 an ounce after touching its lowest in more than a week.

Platinum slipped by 1 percent to $920.90 an ounce, while palladium eased 2.14 percent at $957.55 per ounce.