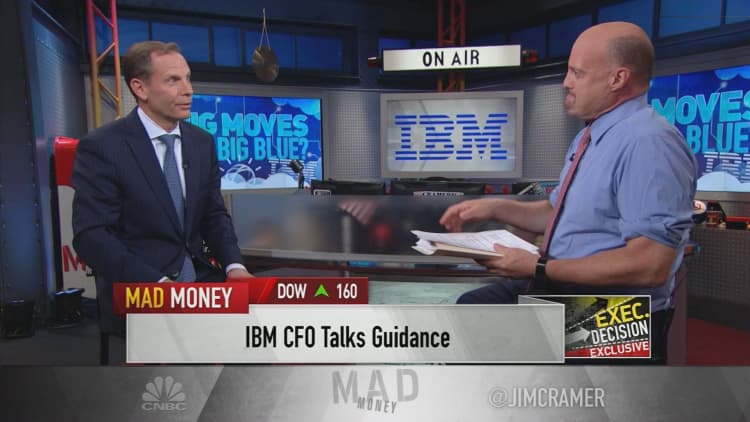

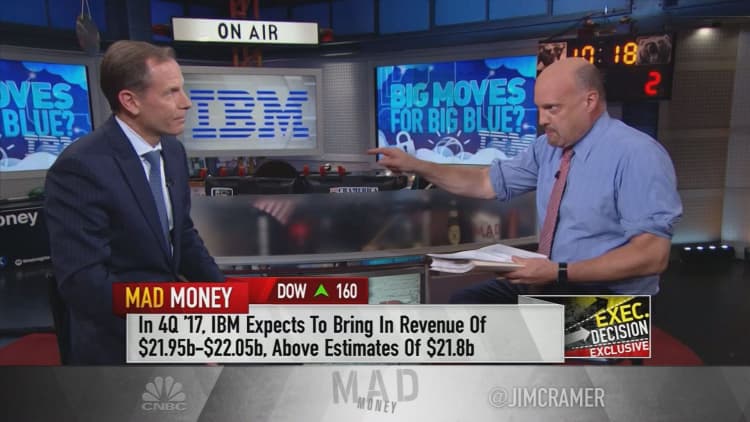

After IBM's better-than-expected earnings report fueled the stock's biggest jump in eight years, CFO Martin Schroeter told CNBC that a weaker U.S. dollar could be a continual driver for IBM.

"We now have, for the first time in probably five years, a good tailwind in terms of the dollar," Schroeter told "Mad Money" host Jim Cramer on Wednesday.

When the dollar weakens relative to foreign currencies, companies' earnings translate into more dollars stateside.

Schroeter said that two-thirds of IBM's business is done outside of the United States, so a weak dollar would be additive to the technology giant's earnings per share.

"We have a global platform. Part of the reason people come to us for our services business and part of the [reason] people come to us for our maintenance business is because of the global platform we can deliver," the CFO said. "Hopefully, we're in a longer term sustainable trend."

IBM is also following the growing trend of cognitive technology adoption. Schroeter said that, in the third quarter, management learned the true breadth of cognitive adoption as clients like the Royal Bank of Scotland continued to deploy IBM's Watson technology.

"The long arc of this, though, is our point of view on how cognitive will change not only enterprises, but it'll change professions. It won't necessarily displace jobs. We've always said that this is not really about automation," Schroeter told Cramer. "[But] it will change 100 percent of jobs."

Because the world is experiencing something of a data glut, Schroeter said that artificial intelligence tech will ultimately be the leading way for companies to understand all the information.

"Our point of view has always been that you need a good set of cognitive technologies to make sense of all that data, and that's what we're helping our clients do. And the quarter, again, reinforced it. We're on the right path," the CFO said.

But while IBM will continue to re-invest in and grow its business, Schroeter admitted that the spending has probably peaked.

"I think we have the bow of the ship through the wave, if you will, on the growth in spending," he said.

With IBM's recent acquisitions, Schroeter said it was time for the company to stabilize its spending so that its newly bought entities would receive the proper amount of money to develop their offerings over time.

So as Big Blue goes through yet another iteration of re-invention, with cloud computing and artificial intelligence accounting for nearly half of the multinational's revenue, Schroeter said the company's prospects are turning positive.

"From a long term trend, we've been investing heavily, and I do think that we've positioned now with a great portfolio, a mix of things that are high-value, things that are accretive and good scale and things that are starting to build like blockchain," the CFO said. "This has been a journey that we've been spending a lot of time and a lot of money [on] in order to recreate the reason IBM exists."

Watch Martin Schroeter's full interview here:

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com