President Donald Trump on Wednesday gathered with senators on the chamber's tax-writing committee — including Democrats — as the GOP crafts a plan it hopes to pass this year.

Before the White House meeting, Trump touted the GOP's tax-reform framework as a tool to unlock economic growth and boost job creation. The president, who has repeatedly said he wants to accomplish the difficult feat of winning Democratic votes, joked about the minority party's support to Sen. Ron Wyden, D-Ore., the ranking member of the Senate Finance Committee.

"I'm sure we'll have unanimous support. I have no doubt. Right, Ron?" Trump said before the meeting, flanked by committee Chairman Sen. Orrin Hatch, R-Utah, and Sen. Claire McCaskill, D-Mo.

McCaskill was one of six Democrats on the Finance Committee attending the meeting with Trump and their Republican counterparts. All except Wyden — McCaskill, Sen. Sherrod Brown of Ohio, Sen. Bob Casey of Pennsylvania, Sen. Bill Nelson of Florida and Sen. Debbie Stabenow of Michigan — face re-election next year in a state Trump won in 2016.

Most or all of the 48 Democrats and independents in the Senate are expected to vote against a Republican tax reform plan. Democratic leaders have argued the framework does not go far enough to reduce the burden on the middle class and does too much to help the wealthy.

Some Republicans could also oppose a bill, depending on what shape it takes.

Trump on Wednesday said the Republican proposal is "really about tax cuts and reform."

"But I focus on tax cuts because it's such an important weapon to get our country moving," Trump said.

Following the meeting, two top GOP senators expressed optimism about finding some Democratic votes for a tax proposal.

"I think it was enormously productive," said Sen. John Cornyn, R-Texas, a Finance Committee member and the No. 2 GOP senator. "The president made clear his preference for a bipartisan bill and there were a lot of ideas that were tossed around."

Sen. John Thune, R-S.D., a committee member and No. 3 Republican senator, said he was "hopeful" the GOP could find Democrats to support a tax bill.

The White House has framed the proposal as tax relief for the middle class. An analysis out of the White House estimates average U.S. household income would rise at least $4,000 per year if the corporate tax rate gets chopped from 35 percent to 20 percent, as proposed.

One independent analysis, though, estimated the GOP framework could actually increase taxes on more than a quarter of middle-class Americans over time.

The Senate this week is expected to pass a fiscal 2018 budget resolution, a step toward unlocking the budget reconciliation process. Using those rules, the Senate can pass a tax plan with only Republican votes.

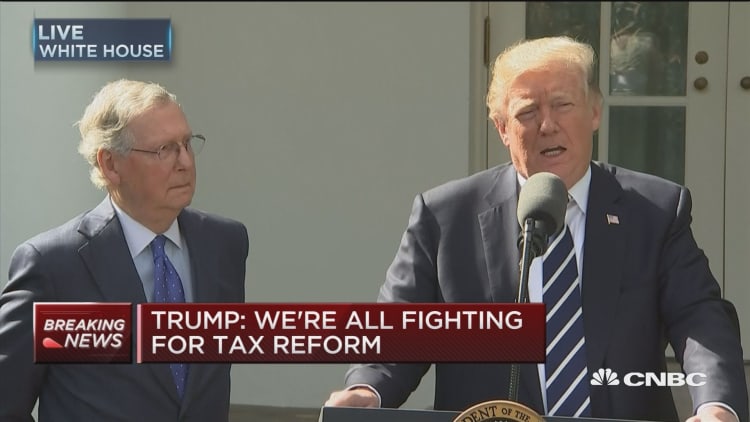

Trump and Senate Majority Leader Mitch McConnell want to pass a tax bill this year. That could prove a difficult task, as tax-writing committees have not yet introduced a bill and lawmakers face multiple other deadlines before the end of the year.

Treasury Secretary Steve Mnuchin says the health of the stock market hangs in the balance with tax reform.

WATCH: Trump says this is a once-in-a-lifetime opportunity for tax reform