Activist investor Nelson Peltz said Wednesday the fierceness of a company's fight against an outsider likely indicates how poorly the business is doing.

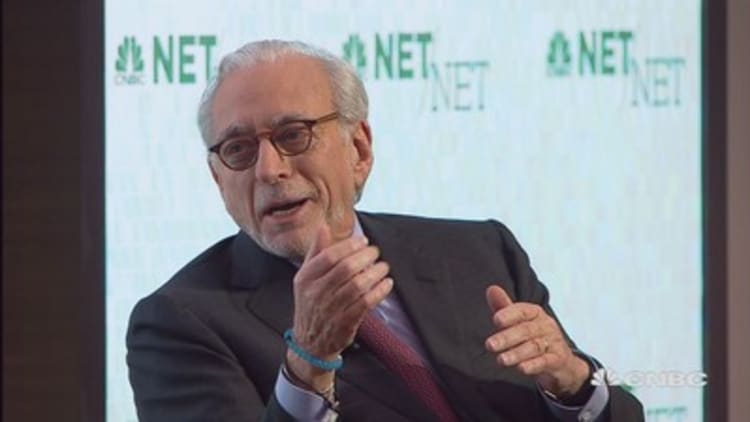

"I believe that there is a direct correlation between how poorly a company is doing and how big of a fight they put up," Peltz, CEO and founding partner of Trian Partners, said Wednesday. He was speaking at CNBC's Net/Net Summit in New York City about his struggle to get onto the board of Procter & Gamble.

Peltz previously estimated P&G has spent more than $100 million in its fight against him.

As an activist fund, Trian buys large amounts of shares in a company and then pushes for changes in the board of directors or business strategies in an attempt to increase shareholder profits.

P&G, the largest company in history to face a proxy fight, said on October 10 that shareholders rejected Peltz's bid for a seat on the company's board. Peltz has not conceded the vote and an official count could take weeks. Shares have fallen more than 5 percent in the two weeks since.

"I think it got ugly one sided. I think that all we dealt with was facts," Peltz said Wednesday. P&G CEO David Taylor "was available to talk at all times. The problem was they didn't want me in the inner sanctum. They didn't want me to have the real numbers."

Taylor told CNBC on the day of the vote announcement that investors support his company's strategy.

Trian has a roughly $3.5 billion stake in P&G.

Activist hedge funds are launching more campaigns against larger companies this year, according to ActivistMonitor, a division of research firm Acuris. But activists appear to be struggling. Settlements with companies dropped 53 percent in the first half of this year, according to the data.

ADP has also fought vigorously in the last few months against a campaign by activist investor Bill Ackman.

Separately Wednesday, in response to a question from U.S. Secretary of Commerce Wilbur Ross, Peltz said he still supports President Donald Trump.

"We got a pilot, his name is Trump," Peltz said. "And like it or not, we only have one pilot. Why don't we get behind this pilot and support him instead of crying in our beer that someone else didn't get elected and picking him to pieces. Is he perfect? No. But he is our pilot so let's land this plane."

— CNBC's Liz Moyer contributed to this report.