The Federal Reserve could sound a bit more hawkish Wednesday if it points to the economy's recent performance, but it's the for-now private conversation around the table that could set the agenda for the next Fed.

Markets, meanwhile, are looking everywhere else for direction, including the anticipated release Wednesday of the House tax plan. There is also Thursday's announcement by President Donald Trump of who the next Fed chair will be after Janet Yellen's term ends in early February.

The central bank is not expected to raise rates at this meeting, as Fed Chair Yellen presides over one of her last meetings this week. Trump is widely expected to nominate Fed Governor Jerome Powell to succeed her, and a possible later announcement could be made on Stanford University economist John Taylor, who Fed watchers say could be named vice chairman.

"The Fed meeting is obviously going to be more interesting in the Fed minutes because of the growing division within the Fed," said Diane Swonk, CEO of DS Economics. "They are in a debate about whether they can forecast inflation and whether rates are appropriate." The minutes from the meeting will be released Nov. 22.

The Fed releases its post-meeting statement at 2 p.m. EDT Wednesday, and it is unlikely to say much new, other than give a nod to how well the economy performed despite major hurricanes. That alone should be enough to encourage markets that the Fed is moving toward raising interest rates at its December meeting.

"I think the Fed is on track for a December rate hike," said Justin Lederer, rate strategist at Cantor Fitzgerald. "It's hard to see how 2018 is going to play out because we don't know who the next Fed chair is going to be, who the next Fed vice chair is going to be and there's lots of seats to be filled."

Swonk said the big discussion at the meeting will probably center on why inflation has remained so low and whether it is transitory or signaling something else. Fed members are questioning whether they are using the correct metrics and how they should view interest rates as a result.

The discussion over inflation is unlikely to change, and if anything pick up momentum if inflation stays low. An even more hawkish Fed was already expected to emerge next year with Cleveland Fed President Loretta Mester returning to the voting ranks, and the appointment of a new chairman and other members.

"This division is growing. Powell won't change the debate but there are other dynamics on the committee. He's got to corral the cats and he's going to have a harder time corralling cats than Yellen did," Swonk said.

She said that if Taylor, known for his rules-based approach to rate hikes, or the Taylor rule, becomes Fed vice chair, he would add to the debate. The wedge dividing the central bank could widen further, and that could be the challenge for Powell.

"It's going to be very hard to corral the cats with Taylor because he has very strong views," Swonk said.

The Fed has agreed on winding down its balance sheet, and it is unlikely to say much about that process which started a month ago.

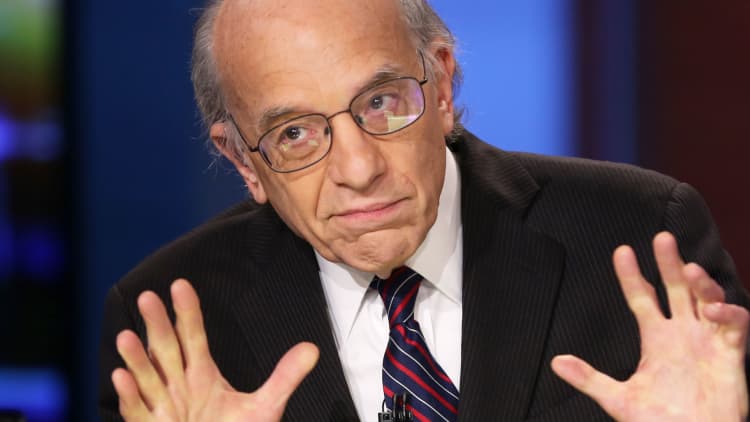

"I don't think the Fed is going to change the picture they painted the last time they met," said economist Milton Ezrati of Vested. "If anything, the news since they met last favors the hawks."

Despite September's weak jobs report, other data have been strong including third-quarter GDP which grew at 3 percent.

Data expected Wednesday includes ADP jobs at 8:15 a.m. EDT, manufacturing PMI at 9:45 a.m. and both ISM manufacturing data and construction data at 10 a.m. There are also car sales for October.

WATCH: CNBC Fed Survey says 96% chance of December hike