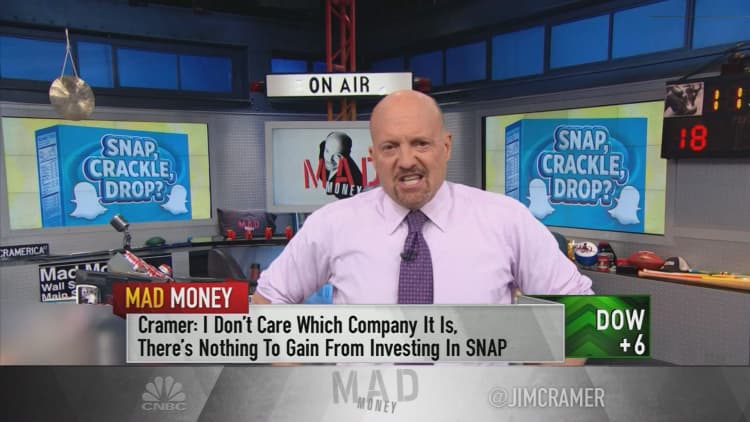

There's no way Snap Inc. would have been able to have the same kind of bombastic IPO it had if it came public in the wake of its latest earnings report, CNBC's Jim Cramer said on Wednesday.

"I'll tell you one thing: you wouldn't get these prices, no way. There's no way we'd actually pay just under $13 bucks for this thing in an IPO, even though the stock fell almost 15 percent today on what can only be considered hellish earnings," the "Mad Money" host said.

After a dismal post-earnings call in which management said business is slowing, Snapchat is lagging behind its competition and that the company had purchased more Spectacles than it thought it could sell, Cramer wondered how the social media giant amassed its $15.5 billion valuation.

"This is bush league, people," he quipped.

To Cramer, the worst confession of all was that 80 percent of Snap's ad impressions were being delivered programmatically, which uses algorithms rather than hand-crafted campaigns to place ads where people see them.

"Programmatic ads ... shred your margins and they never return to the old level because advertisers are just going to go where the algorithms say they can get the best results," Cramer said.

The "Mad Money" host saw this as a sign that companies were simply sampling Snap's platform at the time of its initial public offering, and now, realizing that it's not worth the investment, they are fleeing in droves.

Cramer was also concerned about CEO Evan Spiegel's announcement that Snap would redesign the Snapchat app. On the call, the CEO told listeners, "I look forward to surprising you."

"Jeez, that's the last thing we want from Snap, another surprise," Cramer said.

All in all, Cramer got the feeling that nobody was really holding management's feet to the fire, and that the company was banking on a vague "long term" theory to correct its losses.

"Some people always believe that," he said. "Nevertheless, in the stock market, sometimes bad is bad. Not only should Snap be worth much less than $15 and a half billion, I question, should it even be public? In fact, if they'd waited three more quarters to do the IPO — meaning right here — the stock likely wouldn't be anywhere near this high. With these numbers, you know what, it might not even have been able to come public at all."

WATCH: Cramer goes over Snap's quarter from hell

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com