The GOP's tax bill is excellent for the stock market, but perhaps not as good for U.S. workers, CNBC's Jim Cramer said Monday.

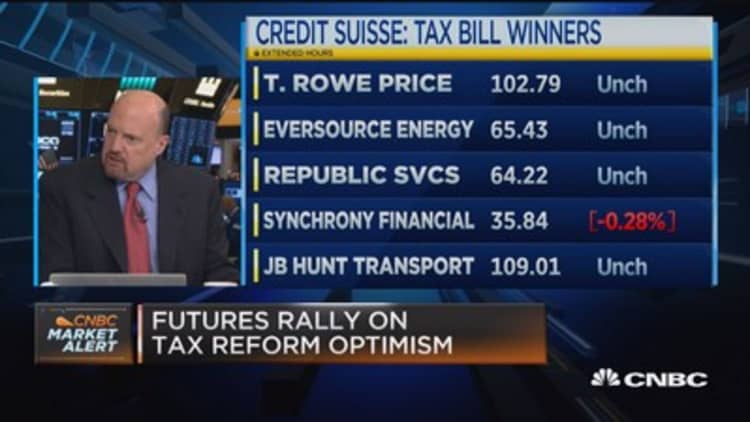

Stocks were sharply higher Monday after Senate Republicans passed their tax bill early Saturday, moving President Donald Trump and the GOP closer to overhauling the U.S. tax system. The House approved its bill last month.

During the bill's creation, a criticism of the proposal was that it massively benefited corporations and the wealthy while having mixed results for others.

When asked, Cramer agreed Monday that the bill is for people who have capital. "I said on Friday that it may not be good for the workers, but boy is it good for the stock market," he said on "Squawk on the Street."

"It's funny because the president tweets about the stock market and then delivers a bill that's good for the stock market," Cramer added.

President Donald Trump praised the Senate for passing "tremendous tax reform. On Monday, Trump said on Twitter that the passage could be "big day for the Stock Market - and YOU!"

Regarding the market's rise Monday, Cramer said, "There was a belief that nothing could happen and that the Senate would fail."

"A lot of analysts are going to be stuck raising numbers," the host of CNBC's "Mad Money" added. "I say stuck because there were so many people who felt 2018, the market looked expensive. I know the people that think that will come up with a new reason why you shouldn't buy."

Cramer also mentioned that if people were "not from one of these states that didn't vote for President Trump, I would be so happy right now." He was referring to an item in the Senate bill that would eliminate federal deductions for state and local taxes. Tax analysts say the move could harm high-tax blue states.

The Senate and House must now reconcile their versions of the legislation, and Republicans hope a deal will be achieved by Christmas.

— Reuters contributed to this report.