Sometimes, CNBC's Jim Cramer is content with taking things at face value.

That's at least how the "Mad Money" host felt about the U.S. Labor Departments nonfarm payroll report on Friday, which showed healthy job growth with little inflation.

"The jobs report, frankly, had something for everyone," Cramer said. "Good manufacturing growth, ... tame wage growth — I know that's not great for the vast majority of people who work for a living, of course, but it is terrific if you're a business that wants interest rates to stay relatively low, and those businesses tend to have stocks attached to them. At the same time, there was enough ammo for the Fed to tighten when it meets next week."

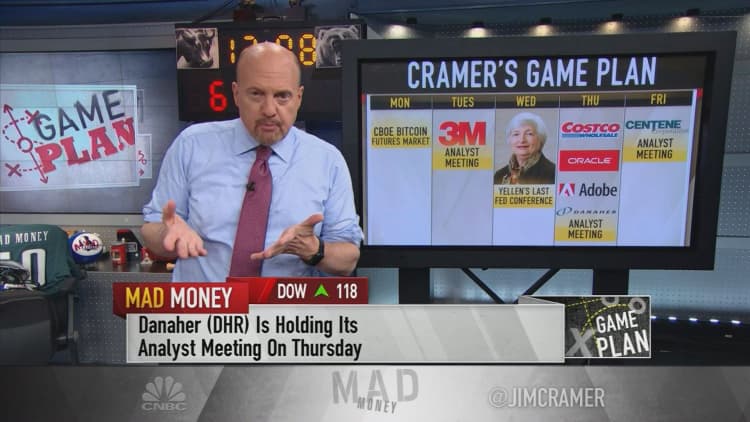

With this set-up in mind, Cramer turned to the stocks and events he'll be watching next week:

Monday: Bitcoin

Sunday marks the first day that non-miners will be able to trade bitcoin futures on Cboe, creating the first two-way market in the digital currency.

"I bet they start to tame the bitcoin phenomenon," Cramer said. "I don't necessarily mean it'll go down, although I have my suspicions that short-sellers will use the futures to blast bitcoin lower. What I mean is that, so far at least, bitcoin is the least transparent financial bubble I've ever seen."

Cramer is curious to see how bitcoin fares trading on a prominent exchange with possibilities for hedging and high-volume trading.

Tuesday: 3M

Shares of 3M slipped on Friday after JPMorgan analyst Stephen Tusa put a "sell" rating on the stock. Cramer hoped that the company's Tuesday analyst meeting would give management an opportunity to shed light on its prospects.

Given that shares of the old-line manufacturer have run 33 percent this year and that CEO Inge Thulin has lifted the company out of other tough situations, Cramer pushed back against Tusa's analysis.

"Look, Tusa does incredibly high-quality work. He got you out of GE. He told you exactly how bad things were at the troubled industrial when others, including top-level executives, were in complete denial. But nobody's right all the time, and I think the under-perform rating that he has on 3M [is] ill-advised," Cramer said.

Wednesday: Federal Reserve Chair Janet Yellen's last meeting

Wednesday will be the last day that Federal Reserve Chair Janet Yellen will face the press as leader of the central bank before Trump nominee Jerome Powell takes over her post.

Cramer said it would be bittersweet, predicting that Yellen's speech would set up for the much-anticipated December rate hike but saying that the market would miss her when she's gone.

"I bet we'll look back and marvel at how she helped engineer this strong economy, one that has very little inflation, and I think the people who don't give her the credit she deserves ... should be ashamed," he said. "I wish Yellen the best of luck when she leaves the Fed and we are most fortunate for her service. I expect no surprises on Wednesday, but I am now convinced that if she doesn't raise rates we are actually going to get a very big bank sell-off."

Thursday: Costco, Oracle, Adobe

Costco: Bulk retailer Costco will report earnings on Thursday. Cramer expects "excellent" results, but he'll be watching the retailer's online offerings, which gave it grief last quarter.

Oracle: An earnings report from cloud giant Oracle will give the market more clarity on whether the company can hold its own against the likes of Alphabet, Amazon and Microsoft.

"Last time, Oracle's stock popped when it reported, but then it gave up the whole gain," Cramer said. "Maybe it pops again, but the trajectory from after that last quarter makes me wary."

Adobe: After meeting with CEO Shantanu Narayen in June, Cramer knows the fundamentals of Adobe's business are promising. But given the recent volatility in the tech sector, he's not so sure about its stock ahead of its Thursday earnings report.

"My take is that trading Adobe may be a bad call because it's too hard," he said. "That said, I like it as an investment if you're willing to buy the stock and hold it given the company's dominance in online marketing."

Friday: Centene

An analyst meeting at health care colossus Centene will provide more details on the enterprise giant's operations, but Cramer wanted investors to watch Washington as well.

"CEO Michael Neidorff has been able to offer health care at reasonable prices all across the country and his company has profited mightily from Obamacare," Cramer said. "I think it will profit in any environment because they've got a lot of exposure to Medicaid and they do well, so you always need to keep your eye on Washington with this one, just in case Paul Ryan ever musters up enough support to take an ax to healthcare spending."

That said, Cramer recommended investors wait for the stock to come down before buying.

Final Thoughts

Cramer added that all of next week's events will happen on the backdrop of the conference committee's evaluation of the GOP tax bill.

"Either way, the bottom line is simple: we're in a market that turns on a dime, and until we have more stability, you need to be ready to buy your favorites on market-induced weakness, as nearly every stock seems susceptible to fickle intra-day agony and ecstasy that you can profit from if you can handle the emotional thicket," the "Mad Money" host said.

WATCH: Cramer's tech-and-bitcoin game plan

Disclosure: Cramer's charitable trust owns shares of General Electric and Alphabet.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com