Struggling to stay afloat, Mattel released updated full year and fourth quarter guidance, anticipating a disappointing holiday season. The toy maker predicts "gross margin deterioration," during what is typically the biggest shopping season of the year.

"The unfavorable year-over-year gross margin experienced during the first nine months of 2017 is expected to continue throughout the fourth quarter of 2017, as a result of unfavorable product mix, higher freight and logistics expense, and lower fixed cost absorption," the company said in a filing with the Securities and Exchange Commission. "In addition, continued negative trends in top line performance for the balance of the year could result in additional gross margin deterioration as a result of higher inventory write-downs and discounts offered to clear inventory."

Mattel said it expects its fourth quarter operating income margin to be significantly lower year-over-year, and anticipates 2017 full-year gross sales will decline by the mid-to-high single digits compared to 2016.

The revised guidance hints at worsening conditions within Mattel, which has watched its margins suffer for years from cheaper imports, competition from big box retailers and the impact of technology on toys.

"Based on preliminary quarter-to-date data for the fourth quarter, Mattel currently anticipates its gross sales during the fourth quarter of 2017 will continue to be negatively impacted by key retail partners moving toward tighter inventory management and by challenges in the Toy Box and certain under performing brands," Mattel said in the filing.

In October, Mattel announced a program to be launched in 2019, that would aim to cut annual costs by $650 million. In the updated filing, executives were not confident they could achieve these goals.

"There can be no assurance that Mattel will be able to realize the anticipated cost savings from its previously announced cost savings plan in the amounts or within the anticipated time frames or at all," the company wrote in the filing.

Three rating agencies, Fitch, Moody's and S&P Global Ratings, all downgraded Mattel stock on the news.

"The rating downgrade reflects our view that Mattel's efforts to restore profit margins and reduce leverage will take longer than originally expected," Moody's SVP Linda Montag said in a statement.

Mattel has had harder a time staying current with changing trends than competitors. Despite its struggles, the toymaker has rebuffed several acquisition offers from competitor Hasbro.

Mattel stock is down 45 percent year-to-date.

Mattel did not immediately respond to request for comment.

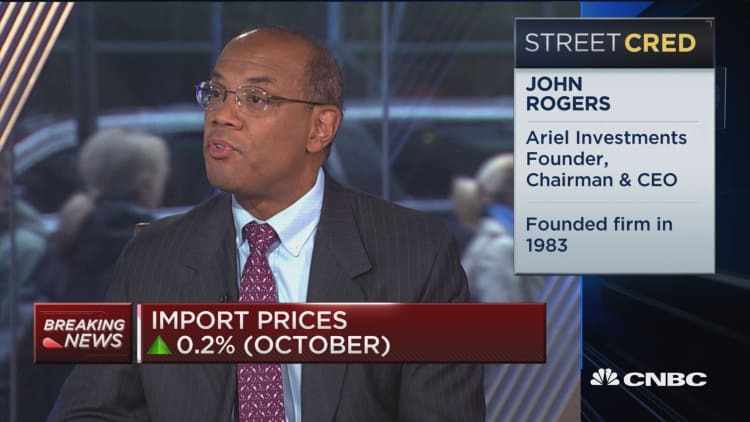

WATCH: The value of putting Mattel and Hasbro together