After the Dow Jones industrial average hit yet another all-time high on Tuesday, CNBC's Jim Cramer had to investigate to see if the white-hot index is showing any signs of cooling.

"I think it's worth asking which red-hot groups will have the staying power once 2018 rolls around," the "Mad Money" host said. "And as far as hot sectors go, nothing has been as hot as the industrials, powered by tremendous economic growth both here and overseas."

With a White House infrastructure plan and a congressional tax overhaul seemingly on the horizon for 2018, industrial stocks could still get a boost from the federal government's actions.

So Cramer called on technician Bob Lang, the founder of ExplosiveOptions.net and one of the three minds behind TheStreet.com's Trifecta Stocks newsletter, to see if the industrials' already lengthy rally can continue into the new year.

Cramer began with the daily chart of Caterpillar, the global manufacturer of construction equipment and machinery. Caterpillar's stock is up 55 percent for 2017, a stone's throw from its all-time highs.

Lang liked the stock's high trading volume, an indicator technicians use to verify dramatic moves. High volume means that there are a lot of buyers pushing the stock higher, so Lang thought the move was telling the truth.

Better yet, Caterpillar's moving average convergence divergence (MACD) indicator just made a bullish crossover — a reliable signal that it can go even higher — and the stock has a floor of support at $139, down roughly $4 from where it closed on Tuesday.

"Put it all together and this chart's got a lot going for it," Cramer said. "Lang says Caterpillar is his favorite name in the group, and this combination of positives makes him think the stock could take a run at $155 or even $160 early in the new year."

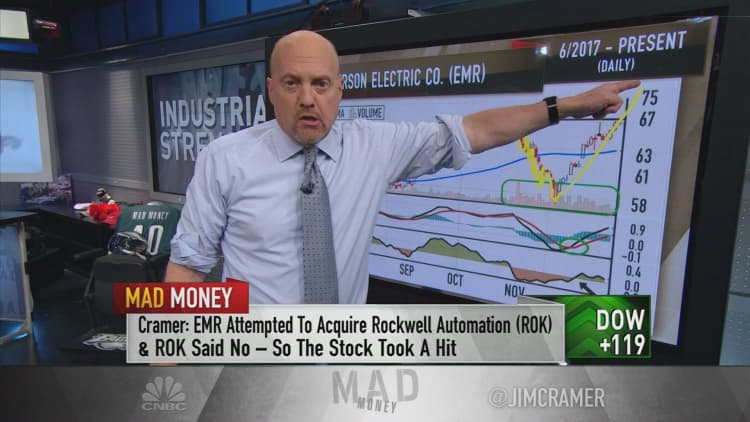

Next, Cramer turned to the daily chart of Emerson Electric, an industrial focused on engineering and automation.

Since Emerson gave up trying to acquire Rockwell Automation last month, its shares have been on a tear, with a 13 percent gain just since mid-November. Just like Caterpillar, the stock has showing high volume and a bullish MACD indicator.

"Lang says the V-shaped bottom pattern tends to be quite bullish — he could see this stock ... take a run at $75 in the not-too-distant future," Cramer said. "At the moment, the stock's trading at $66. Lang says he'd love to buy it on a pullback to $63, where Emerson has the support of the 50-day moving average ... but who knows if you'll get that kind of decline?"

Honeywell's stock also surged in November on high volume, according to its daily chart, but lately, it looks like it's run out of steam.

Lang said shares of Honeywell may have gotten overheated, but noted a few positives: the pullback happened on lower volume, meaning there aren't any major sellers, and the stock has been holding above its floor of support.

"Put it all together and as far as Lang's concerned, Honeywell just needs to re-charge," Cramer said. "He could potentially see this $153 stock running up to $170 near the beginning of the new year, which would be stupendous."

Finally, Cramer and Lang inspected the daily chart of United Technologies, an industrial stock with aerospace exposure that has consistently been reaching new highs.

"Lang thinks this is a very powerful trend," Cramer said. "He sees the $123 stock possibly going to the $130s before too long, although ideally he recommends waiting for a pullback to $120, where UTX has a nice floor of support."

But, like with the others, Cramer warned that United Technologies may not see much lower levels again in the near future, at least not again in 2017.

"It's a good time to be an industrial company, and the charts, as interpreted by Bob Lang, suggest the industrial stocks are going to continue to have a good time right into year-end," the "Mad Money" host concluded. "He likes Caterpillar, he likes Emerson Electric, Honeywell [and] United Technologies, and I've got to say I agree with him. All we can do is hope that these stocks come in and give us better prices as part of some sort of market-wide sell-off that has nothing to do with their businesses. Why? Because their businesses are red-hot."

WATCH: Cramer's charts predict a rosy year-end for industrials

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com