Of all the breaks that are on the chopping block due to the Republican tax overhaul, families may miss the personal exemption the most.

The "Tax Cuts and Jobs Act," nearly doubles the standard deduction to $24,000 for married couples who file jointly and $12,000 for singles.

That's up from $12,700 for married couples and $6,350 for individuals in 2017.

The increase in the standard deduction comes at a cost, however: Starting in 2018, the tax overhaul repeals personal exemptions, which are valued at $4,050 per taxpayer, spouse and dependent in 2017.

Families, especially those with multiple children and single-parent households, will keenly feel the loss of these exemptions, even though these tax breaks are supposed to return in 2025.

"Doubling the standard deduction is nice if you're a married couple with no kids," said Stan Veliotis, director of the Center for Professional Accounting Practices at Fordham University.

"But bigger families won't get as much of a benefit on that," he said.

Here's what the personal exemption means to households with children.

Value of exemptions

Under current law, a married couple with adjusted gross income of $75,000 and two kids would have a total of $16,600 in personal exemptions in 2018 (or $4,150 per person, due to inflation adjustments).

When including the standard deduction of $13,000 for married filing jointly, the filers' taxable income falls by $29,600, according to case studies from the Urban-Brookings Tax Policy Center.

Meanwhile, under the new tax bill, this same couple would have only the standard deduction of $24,000 for joint filers who are married.

The couple would benefit from the enhanced child tax credit, which will double to $2,000 per child under the GOP's tax overhaul.

In all, the family's taxes would fall by $2,119 in 2018, according to the Tax Policy Center.

"It's a trade-off: You lose the personal exemption, but you get a bigger child tax credit and standard deduction," said Howard Gleckman, senior fellow at the Tax Policy Center. "When all that goes away, you pay a little more."

Inflation indexes

By 2027, this hypothetical family with two kids would wind up paying an additional $150 in taxes, compared with what they'd pay under today's framework because the enhanced child tax credits — and a range of individual income tax provisions — expire in 2025, the Tax Policy Center found.

That family would also suffer because the tax overhaul changes the metric the IRS uses to adjust brackets, standard deductions and other details for inflation.

Today, inflation adjustments are based on the consumer price index. The bill, however, changes to the chained consumer price index, which rises more slowly.

In turn, this means the inflation increases for the standard deduction and the tax brackets would be less generous than they are now and could result in tax increases for filers in the future.

"The personal exemption will come back, but it becomes less valuable," Gleckman said. "It goes to the chained CPI and the increase for inflation will be smaller over time."

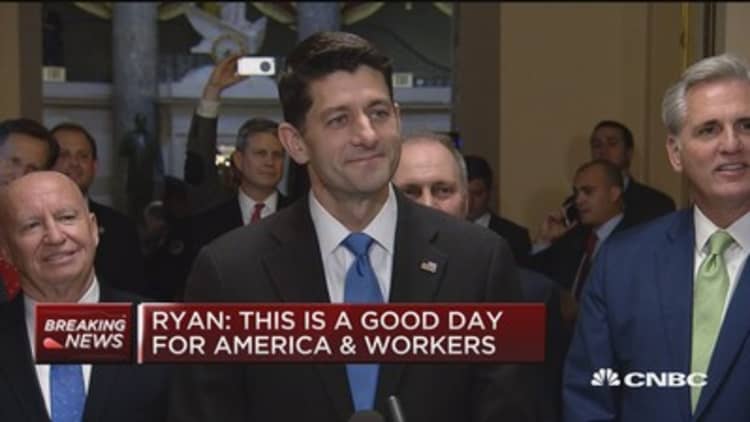

WATCH: Speaker Paul Ryan: Tax bill was a promise made and a promise kept