Times are about to become more complicated for single parents and their kids if the GOP tax overhaul becomes a reality.

Unmarried parents who file as "head of household" often shoulder the majority of expenses for keeping up their homes, and they mostly maintain custody of their dependent children.

Some 22 million taxpayers filed their 2015 income tax return under this status, according to IRS data.

Tax experts are concerned that with the loss of personal and dependent exemptions in both the House and Senate tax proposals, and the expiration of child tax credits in Senate bill, single-parent households may lose.

In the Senate bill, narrower brackets for heads of household who earn more than $70,000 a year could also subject those filers to higher taxes.

"I would be most worried about single-parent families and also very large families," said Elaine Maag, senior research associate at the Urban-Brookings Tax Policy Center. "That's because that personal exemption is so valuable to them."

Here's how the financial picture would change for single-parent households.

No personal exemptions

Both bills would roughly double the standard deduction, which is currently $9,350 for heads of household.

Proposed legislation from the House and Senate would also end personal exemptions.

Under current law, a single parent with two children can claim a standard deduction of $9,350, plus personal exemptions of $4,050 for herself and each child. This reduces her taxable income by $21,500.

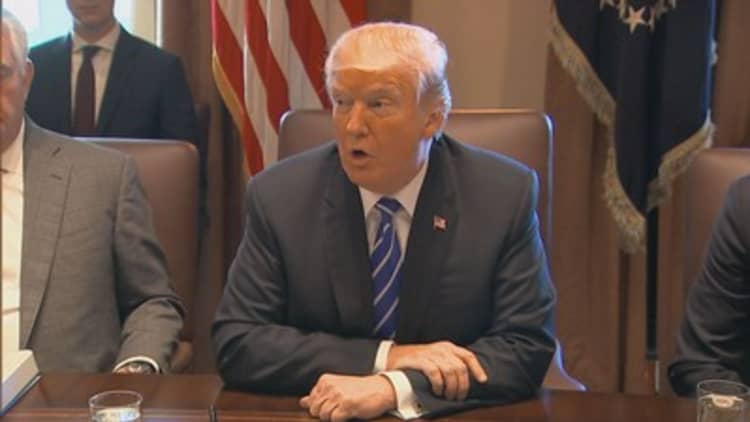

Watch: GOP plan will ultimately raise taxes on 50% of Americans: Tax Policy Center

Under either the Senate or House bill, this same parent would only be able to deduct the newly proposed standard deduction of approximately $18,000.

"The head of household filing status helps divorced women, especially if they have dependent children," said Avani Ramnani, director of financial planning and wealth management at Francis Financial in New York.

"Under that status, these filers get a higher deduction and the exemptions," she said. "To take that away is pretty big."

Child tax credits

Both proposals call for an increase in the child tax credit, which is currently at $1,000 per child under age 17.

Under the House proposal, this credit would increase to $1,600, while the Senate would boost it to $2,000 and make it available to children under age 18.

However, the expansion of the child tax credit under the Senate plan would expire by the end of 2025.

These changes aren't particularly beneficial to households with multiple children.

"The child tax credit isn't going to offset the loss of personal exemptions," said G. William Hoagland, senior vice president of the Bipartisan Policy Center. "If you have a large family, it's a big issue, and unfortunately large families tend to be in the middle-to-lower income quintiles."

Though the House bill establishes a new family tax credit of $300 for dependents other than children, this provision is set to expire at the end of 2022.

Narrower tax brackets

See below for a breakdown of the tax brackets under current law, the Senate proposal and the House proposal.(Click on the expansion icon to get a full view.)

Under the Senate proposal, heads of household would be subject to the same tax rates and brackets as single filers without children starting at $70,000.

That means these taxpayers will have more of their income subject to taxes at a higher rate.

"Relative to current law, the brackets for heads of household are narrower," said Maag.

"Put another way, usually heads of household have more income taxed at lower rates than singles," she said. "That isn't true for many people under the Senate proposal."

More from Personal Finance:

Time is running out to lock in your Medicare coverage

The 9 best European retirement destinations

These Black Friday gifts are worth the crowds

Senate tax bill could undermine tax-harvesting robo-advisors