Booming Nintendo Switch sales have put video game stocks back on Jim Cramer's mind, so the CNBC host turned to the charts to see what 2018 could have in store for the gaming names.

"There's a whole generation of people out there who can't remember a world without Nintendo, and many of them are now old enough to spend meaningful chunks of their bucks on their hobbies," the "Mad Money" host said. "Plus, the technology just keeps getting better and better, including the chips that it's run on, making games more and more alluring for couch-bound millennials."

So Cramer enlisted technician Rob Moreno, his RealMoney.com colleague and the publisher of RightViewTrading.com, to help him take a closer look at the space.

Cramer started with the daily chart of Take-Two Interactive Software, the best-performing stock in the group with a 127 percent gain in the last year.

The $13 billion company behind the wildly popular Grand Theft Auto and NBA 2K franchises has far outperformed larger rivals Electronic Arts and Activision Blizzard in the stock market.

But Take-Two's stock hit a snag in November, when it fell below its 50-day moving average and began to consolidate into a cup-and-handle pattern.

"Now, this cup-and-handle formation is important — it looks like a little cup, the bottom, followed by a period where the stock trades sideways, looking like a handle — and it's one of the most reliably bullish patterns in the book," Cramer said.

Last Friday, Take-Two's stock managed to push through its $115 ceiling of resistance as the stock's moving average convergence divergence indicator (or MACD, signified by the black line) made a bullish crossover, suggesting the stock was about to start running.

"Moreno thinks the stock has a lot going for it here and will soon be ready to resume it's long-term march higher," Cramer said. "That said, he doesn't think Take-Two is the best bet in the video game space right now, simply because Activision and EA have much more room to run."

Moreno's case for Activision, the giant behind Call of Duty, World of Warcraft and Overwatch, was tied to a specific indicator on the stock's daily chart.

Shares of Activision have been making a comeback since December, when the stock slid below its floor of support before bouncing higher. But it has maintained its $67 ceiling of resistance for months — a level Moreno doesn't think will hold for much longer.

Moreno pointed to the chart's stochastic oscillator, a tool that measures whether a stock is overbought or oversold.

"The oscillator just recently ... crossed above the center line. When it does that, Moreno says that's a sign that the stock is ready to gallop — important since it's only a buck away from the ceiling of resistance," Cramer said. "This four-month period of consolidation, which has been torture, is like a coiled spring, he says, ready to propel the stock higher."

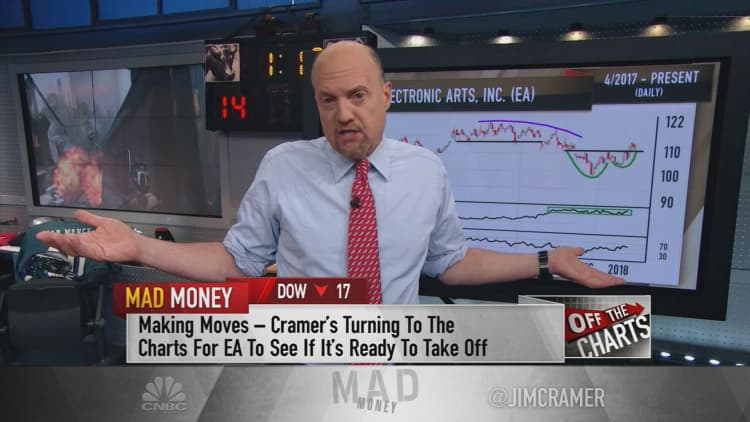

Moreno had a similar outlook for Electronic Arts, which produces Battlefield, The Sims and a host of licensed sports games including FIFA.

Like Activision, Electronic Arts' stock had been consolidating for months before forming a cup-and-handle pattern in December under its $110 ceiling of resistance.

But even though the stock has trumped its ceiling, closing Wednesday at $112.25, its trajectory remains murky. While its relative strength index, a key momentum indicator, has been trending higher, its accumulation/distribution line, a tool that measures money flow, has stayed flat.

"This is going to need to pick up before Moreno will really believe that EA is ready to run, but once it does, he thinks the stock could have a ton of upside," Cramer said.

So as the gaming industry continues its seemingly unstoppable uptrend in 2018, Cramer and Moreno expect the rising tide to lift these boats.

"The video game space remains one of the hottest secular growth groups around, and I think these stocks have more room to run in 2018, including Take-Two Interactive," the "Mad Money" host said. "But the charts ... suggest that Electronic Arts and Activision Blizzard could end up giving you better performance this year as they start to play catch-up to this tremendous out-performer run by Strauss Zelnick."

WATCH: Cramer's charts bullish for video game names

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram - Vine

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com