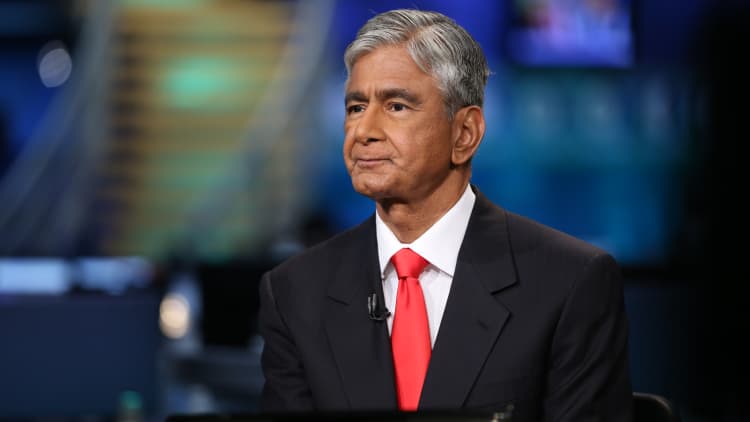

Komal Sri-Kumar, whose economic consultancy advises multinational firms and sovereign wealth funds, told CNBC that the rise in the yield of the 10-year Treasury may not last for long.

"I think it is due to come down again," Sri-Kumar, founder and president of Sri-Kumar Global Strategies, said Wednesday on "Power Lunch."

The yield on the benchmark 10-year Treasury note rose Wednesday to 2.845 percent shortly before 3 p.m. ET. This was the same level that triggered Friday's stock market sell-off. A budget compromise Wednesday among congressional leaders may have also triggered rates to increase.

But while many investors remain optimistic about a rise in inflation and 3 percent economic growth, Sri-Kumar said the yields will go back down.

"If they go up in the short term because of nervousness is hard to tell," he said. "But if I were a betting person and I was looking six months ahead, I would be looking for them to be significantly lower."

Sri-Kumar points to earnings workers took home in January — significantly less than December — as one reason.

"When you earn less during a week or a month it is not inflationary, it is disinflationary," he said.

The number of people holding multiple jobs also increased in January, while the total number of hours worked in a week decreased — from 34.6 hours in January 2017 to 34.3 in January 2018.

"Both of those are negative for stocks," he said.

"All of these things tell me that there is a significant amount of slack in the economy," Sri-Kumar said. "It all depends on how the economy grows. And I don't get the vibe that the economy is picking up significantly."