Investors are spooked that a cooling off of Walmart's online sales could mean the company isn't positioned to fend off Amazon's internet dominance after all.

That fear sent shares tumbling more than 9 percent Tuesday, when Walmart said e-commerce sales grew just 23 percent during the latest quarter, lagging prior periods' results.

But analysts and industry experts alike have been quick to point out Walmart is planning a number of investments in its website and overall e-commerce operations that should start to take hold later this year.

"It's a well-positioned huge foundation," said Oliver Chen of Cowen & Co. "What's ahead is technology ... further digitization of supply chain, & strategic use of M&A to drive [e-commerce] share."

People are still underestimating the value of Walmart's store fleet — something Amazon doesn't have — and how bricks and mortar will aid the company in fulfilling more grocery orders and same-day deliveries, Chen wrote in a note to clients. "The theme here is leverage of WMT's physical assets and our view is that the future of eCommerce is physical + digital – this strategy will drive a 'productivity loop.'"

A 23 percent increase in e-commerce sales during the fourth quarter pales in comparison with Walmart's reported growth of 50 percent in the previous quarter. It saw growth of 60 percent in the two periods prior to that.

It's been more than a year since Walmart acquired Jet.com, which gave the company an initial e-commerce boost. Since then, Walmart is starting to shift marketing spend on the millennial-centric upstart to reach younger shoppers directly via Walmart.com, the company explained Tuesday.

"Jet will not grow as quickly as it did in early days, but it will be well-positioned where we've chosen to focus the brand," CEO Doug McMillon said on a conference call with analysts and investors.

"I think what you'll see is Jet will go through a period of adjustment and then it'll start to grow again in the future but focused on specific markets and opportunities," McMillon said. "Whereas Walmart will be the broad-based, big part of the business and growing it will be a priority."

Later this spring, Walmart will reveal a completely revamped website with a focus on fashion and home goods. In partnering with Hudson's Bay-owned Lord & Taylor, Walmart will bring high-end clothing items to its website, in addition to its less-expensive banners, which are also getting a refresh.

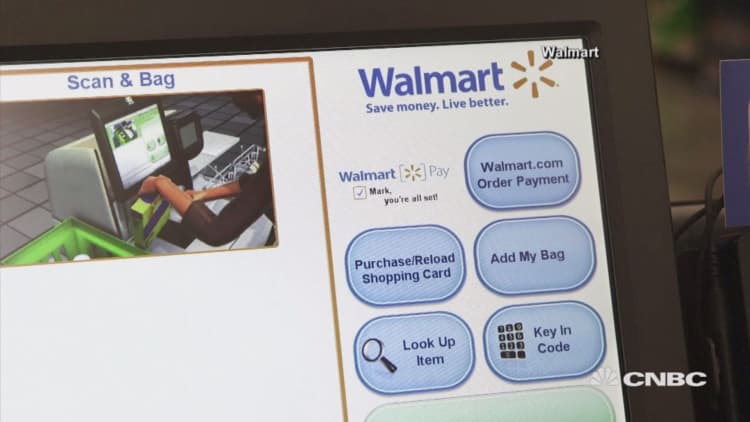

Soon, Walmart.com will also feature the "smart cart" technology made famous on Jet.com. The platform grants shoppers cheaper prices if they pack more items together in one box, use a debit card when paying for purchases or opt out of returns. It's something that has helped Jet.com amass a loyal shopper base — they keep coming back for the promised savings and seamless experience.

Meanwhile, Walmart is transitioning more of its stores to fulfill online grocery orders and deliver those orders curbside to customers. In addition to fashion, grocery is expected to be one of Walmart's biggest areas of investment this year.

Tuesday's results show Walmart "is following the same strategy as Amazon: taking less profit today, for the prospect of a stronger, better business tomorrow," said Neil Saunders of GlobalData Retail. In taking a page from the so-called Amazon playbook, Walmart hopes to beat the e-commerce behemoth at its own game.

Looking to the full year, Walmart expects U.S. e-commerce sales to grow 40 percent in fiscal 2019, matching what it previously expected. Investments in new brands and new technology should ultimately aid the company in attracting new customers, pushing it toward those goals.

Meanwhile, Amazon is making its own advancements in grocery and apparel, treading on Walmart's turf. However, a new report from Coresight Research found that shoppers were largely only visiting Amazon.com because it offered "cheap delivery" and was easy to search. These attributes could easily be replicated and successfully mastered by others, including Walmart.

Many shoppers today "do not associate Walmart with online or they default to Amazon," Saunders said. "We believe this is down to Walmart's focus on low prices plus better customer service, improved ranges, and better-selling environments."

Including Tuesday's losses, Walmart shares have climbed about 35 percent from a year ago.

WATCH: Worst day ever for Walmart investors?