Former General Electric boss Jeff Immelt was consistently overoptimistic in running the large conglomerate during his 16-year tenure, The Wall Street Journal reported Wednesday.

More than a dozen insiders — including both investors and current and former GE executives — told the paper Immelt would project results for the company's future mismatched with its reality.

Those insiders said Immelt's unwillingness to hear bad news led to a number of consequences, including unrealistic financial goals, poorly timed acquisitions and even mismanagement of the company's cash. Immelt also did not want to deliver bad news, the report says, furthering an optimism that downplayed serious risks to GE's businesses.

Even as late as May, a few months before his departure in October, the report says Immelt told investors that GE was a "very strong company."

"When I think about where the stock is compared to what the company is, it's a mismatch," Immelt said at the time.

Shares of GE closed at $14.74 on Tuesday, down more than 44 percent from May. Immelt went so far that day as to declare GE's recent financial results as "pretty good really," maintaining the company would reach his $2 per share profit forecast for 2018. New CEO John Flannery slashed that forecast, with the company's latest outlook estimating earnings per share between $1 and $1.07 this year.

People familiar with the situation told the Journal that internal investigations are now underway. Those sources say that the company is seeking to identify how even GE's board was unaware of how deep problems ran beneath Immelt's veneer of confidence.

A spokesperson for Immelt disagreed with the basis for the report, telling CNBC that "the story ignores the facts and events of the past 16 years."

"He led GE through the 9/11 tragedy, through the global financial crisis and many other bad news events. He's been credited widely for how well and effectively he performed during those bad news events," Immelt's spokesperson said in the statement.

The Securities and Exchange Commission has also opened up an investigation of GE's accounting practices in the wake of the conglomerate's review of its insurance business. On Jan. 16, GE revealed it had conducted a review of its GE Capital insurance portfolio and decided to take a $6.2 billion after-tax charge in the fourth quarter of 2017, and contribute $15 billion over the next seven years to shore up the portfolio's reserves.

The SEC is investigating both the process that led to the insurance reserve increase and the fourth-quarter charge, Chief Financial Officer Jamie Miller said Jan. 24.

GE stock fell nearly 2 percent Wednesday, with less than half of that decline coming after the Journal's report broke.

Read the full report from The Wall Street Journal here.

— CNBC's Berkeley Lovelace Jr. contributed to this report.

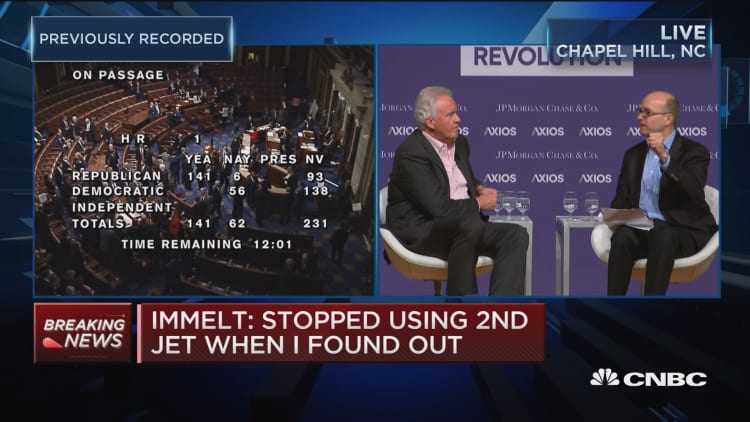

WATCH: Immelt named AthenaHealth chairman