General Electric's stock briefly fell below $14 in Monday trading as investors reacted to news late Friday that the U.S. Justice Department could take action in connection with alleged subprime mortgage violations.

That update, which was made in a filing with the Securities and Exchange Commission, also provided details about the expected restatement of its 2016 and 2017 financial results. Based on this information, some suspect it will be very difficult for GE to reach its 2018 forecast.

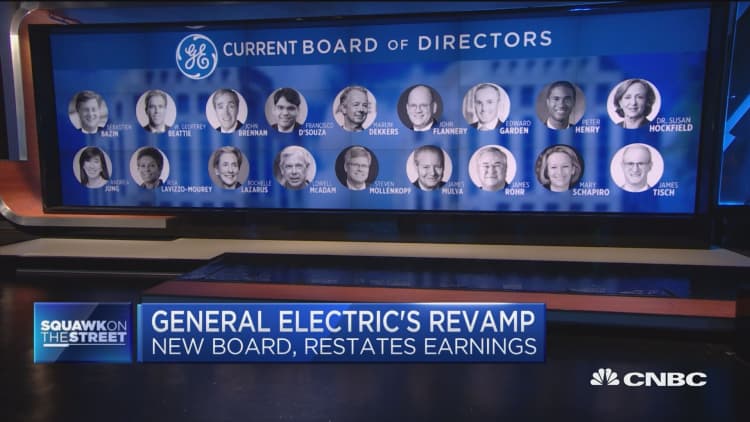

The company, which is in the midst of a restructuring effort, also nominated three new directors, as it looks to downsize its board.

Shares of the company were recently trading down 2.5 percent, after sinking as low as $13.95, a level not seen since July 2010, when GE shares hit $13.81.

"We're still not seeing a bottom yet here on the stock," RBC Capital Markets analyst Deane Dray told CNBC's "Power Lunch."

The update about the Justice Department investigation emerged in a regulatory filing, where GE said the company faces allegations that its GE Capital unit, and its now defunct WMC Mortgage business, violated U.S. law in connection with subprime mortgages.

The department "is likely to assert" violation of financial regulatory law, GE said in the filing, due to "WMC's origination and sale of subprime mortgage loans in 2006 and 2007." The company, which sold WMC in 2007, said the warning about potential Justice action includes the outcomes from investigations of other financial firms.

GE had set aside $626 million in reserves to pay claims filed against WMC, according to Deutsche Bank. However, the reserves have declined to $416 million, and the latest filing means GE may be on the hook for even more, said Deutsche Bank, noting the Justice Department "has fined financial institutions tens of billions" for taking part in the mortgage crisis of 2008.

The Justice Department investigation is separate from the Securities and Exchange Commission investigation GE announced on Jan. 24, which is looking at the company's accounting practices in the wake of the conglomerate's review of its insurance business.

On Jan. 16, GE revealed it had conducted a review of its GE Capital insurance portfolio and decided to take a $6.2 billion after-tax charge in the fourth quarter of 2017, and contribute $15 billion over the next seven years to shore up the portfolio's reserves.

GE is also working to build a new, smaller board of a dozen directors – down from the previous 18. The board changes come as chief executive John Flannery trims GE's portfolio, saying he expects to see the company exit several businesses.

The company nominated Leslie F. Seidman, a former chairman of the Financial Accounting Standards Board; Thomas Horton, who oversaw the restructuring and merger of American Airlines with US Airways; and Lawrence Culp Jr., who as former CEO of Danaher transformed the company from a manufacturer into a science and technology firm. These new directors bulk up the board's experience in accounting and corporate restructuring.

"I think these announcements today about three new board nominees can be a game changer," Dray said, adding that the proposed additions may both turnaround investor sentiment and "cause some real change at the company."

GE also revealed the specifics behind its expected restatement of 2016 and 2017 financial results in Friday's filing. When the company reported earnings in January it had disclosed that new accounting rules would prompt it to reexamine how it accounted for revenue from long-term contracts.

Deutsche Bank, in a note to investors Monday, wrote GE's forecast 2018 earnings appear "increasingly difficult to achieve," casting doubt on its ability to achieve even the low end of the company forecast of $1 to $1.07 per share.

—Reuters contributed to this report.