With interest rates on home loans climbing, homebuyers — or homeowners looking to refinance — might be tempted by the lower initial cost of an adjustable-rate mortgage.

Yet before you sign on the dotted line for a so-called ARM, it's important to understand what you're getting into.

"You need to know the exact terms of the ARM, not just the interest rate at the beginning of the loan," said Stephen Rinaldi, manager at Pando Mortgage in Media, Pennsylvania. "Don't buy into an ARM thinking the rate will stay low forever."

With an ARM, the initial interest rate — which generally is lower than that on a traditional 30-year fixed mortgage — is only fixed for a set amount of time.

After that, the rate could go up or down, or remain unchanged. That uncertainty makes an ARM a riskier proposition than a fixed-rate mortgage. This holds true whether you use an ARM to purchase a home or to refinance a loan on a home you already own.

The ARM adjustment is based on a widely used interest rate index, along with the specific terms of your loan (more about that further below). Commonly used benchmarks include the one-year Libor, which stands for the London Interbank Offered Rate, and the weekly yield on the one-year Treasury bill.

At last count, 6.7 percent of mortgage loan applications were for ARMs. While that's still a relatively small portion, it's up from 5 percent in early January.

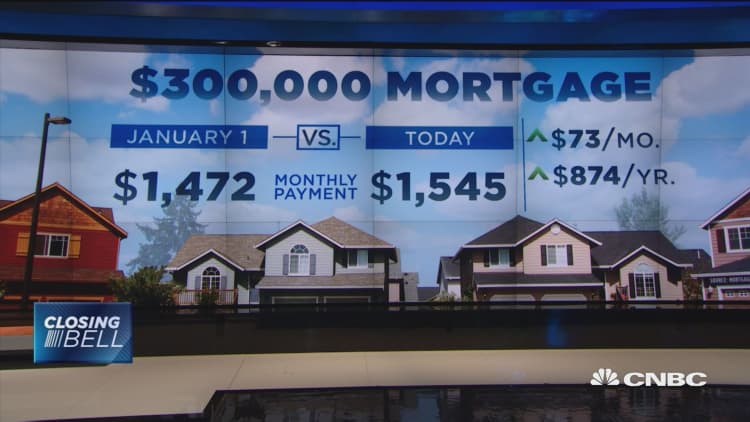

At the same time, the average rate on a traditional 30-year mortgage ticked up to 4.64 percent from 4.23 percent, according to data from the Mortgage Bankers Association. This marks the highest it's been since January 2014.

The average interest rate on one popular ARM — one whose interest rate is fixed for five years and then adjusts yearly — has gone to 3.85 percent from 3.5 percent during that time.

The uptick in interest rates comes as homebuyers face higher home prices. Over the last year, median home values have risen 6.7 percent to $207,600, according to Zillow. The median price of homes listed for sale is $257,990 and the median price of sold homes is $228,200.

If you're among the buyers exploring an ARM, there are a few things to know.

For starters, consider what the name of the ARM means when your lender starts throwing terms around. For a so-called 5/1 ARM, for instance, the introductory rate lasts five years (the "5") and after that the rate can change once a year after that (the "1").

Some lenders also offer ARMs with the introductory rate lasting three years (a 3/1 ARM), seven years (a 7/1 ARM) and 10 years (a 10/1 ARM).

Aside from knowing when the interest rate could begin to change and how often, you need to know how much that adjustment could be.

(Click on the chart to enlarge.)

Mortgage lenders employ a widely used index and add an agreed-upon percentage point (called the margin) to arrive at the total rate you pay. So if the index is at 1 percent and your margin is 2.75 percent, you'll pay 3.75 percent.

After five years with a 5/1 ARM, if the index is at, say, 2 percent, your total would be 4.75 percent. But if the index is at, say, 5 percent after five years? Whether your interest rate could jump that much depends on the terms of your ARM.

An ARM generally comes with caps on the annual adjustment and over the life of the loan (see below information from the Consumer Financial Protection Bureau). However, they can vary among lenders, which makes it important to fully understand the terms of your loan.

- Initial adjustment cap. This cap says how much the interest rate can increase the first time it adjusts after the fixed-rate period expires. It's common for this cap to be either 2 percent or 5 percent — meaning that at the first rate change, the new rate can't be more than 2 (or 5) percentage points higher than the initial rate during the fixed-rate period.

- Subsequent adjustment cap. This clause shows how much the interest rate can increase in the adjustment periods that follow. This number is commonly 2 percent, meaning that the new rate can't be more than 2 percentage points higher than the previous rate.

- Lifetime adjustment cap. This term means how much the interest rate can increase in total over the life of the loan. This cap is often 5 percent, meaning that the rate can never be 5 percentage points higher than the initial rate. However, some lenders may have a higher cap.

Even if your initial interest rate is palatable, make sure you know the highest payment you could be liable for on your loan if rates rise. A Truth in Lending disclosure, which your lender must give you within three days of your loan application, should include this information, according to the CFPB.

Rinaldi said an ARM might make sense for buyers who anticipate moving before the initial rate period expires. However, because life happens and it's impossible to predict future economic conditions, it's wise to consider the possibility that you won't be able to move or sell.

For homeowners considering an ARM as a refinancing option, the same general considerations apply.

Also, if you already were pushing the bounds of your budget to buy a particular house, you need to evaluate whether your financial situation will improve enough to accommodate a potentially higher rate when the first change hits.

"That adjustment will be here before you know it," Rinaldi said.

More from Personal Finance:

What you need to know about rising interest rates

This $2,000 expense could blindside happy homebuyers

A rent-to-own offer on your house could deserve a second look