The board of directors of the New York Federal Reserve bank appears to have settled on San Francisco Fed President John Williams to be its next president, sources tell CNBC, despite pressure to find a woman or a candidate of color — and one with deep expertise in financial regulation.

The job, for which The Wall Street Journal first reported Williams was in the running, is among the most powerful financial sector positions in the country. The New York Fed President serves as the vice chairman of the rate-setting Federal Open Market Committee (FOMC), and the New York Fed supervises the big money center banks in the nation's financial capital.

Williams is a 55-year-old PhD economist, and a leading monetary policy expert who has spent nearly a quarter-century at the Fed. He is viewed as a centrist, supporting gradual rate hikes now. However, he is a leading proponent of the dovish view of keeping a relatively low interest rate for the economy in the long run.

Uncertainty in the White House, specifically the failure so far of President Donald Trump to nominate a vice chairman of the Fed, was also said to be play a role. The New York Fed board felt as if a monetary policy expert was the best choice, given that Fed Chairman Jerome Powell is not an economist. A vice chairman of the board may not be seated for several months, since a person has not yet been nominated.

Williams must still be formally nominated by the New York Fed Board and approved by the Federal Reserve Board of Governors. Unlike the chairman and vice chairman of the Federal Reserve, the NY Fed president is not confirmed by the Senate.

If he takes the post, it would come after the New York Fed's board of directors made several public comments about seeking a diverse pool of candidates for the job. It announced in November, after the resignation of current President William Dudley, that it had hired two search firms to seek his replacement — including one specifically charged with seeking diverse candidates.

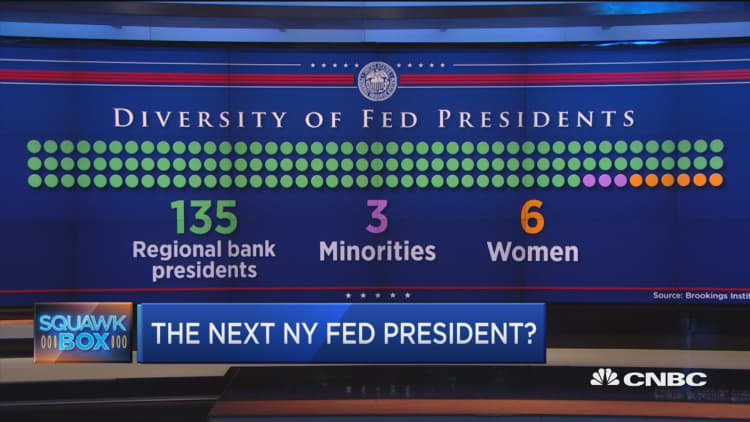

The search itself came after strong criticism from Democrats in Congress and some outside interest groups about the lack of diversity at top positions on the Fed. Since 2014, when three women took policy making roles, none has been among the seven appointments of Fed bank presidents or Fed governors.

Among the seven, however, is one African-American and one Indian-American. Of the 15 bank presidents and governors who make up the rate-setting FOMC, 3 are women.

Importance of monetary policy expertise

But people familiar with the deliberations say Williams' monetary policy expertise became more important, because of the failure of the White House to nominate a vice chairman for the Federal Reserve.

That appointment has been seen as especially critical since Donald Trump nominated Jerome Powell to be chairman of the Fed. Powell is not an economist, and White House officials have themselves said that the vice chair's job needs to be filled by someone with strong economic and monetary policy credentials.

Yet, six months after the resignation of Fed Vice Chairman Stanley Fischer, a leading monetary policy expert, and two months after Senate confirmation of Powell, the White House has yet to put forward a nominee for vice chairman. Columbia University Economics Professor Richard Clarida is said to be the front runner, but he has not been officially nominated for reasons that are unclear.

A White House source suggested recently that the president has yet to approve the appointment, and added that because of nomination delays in Congress, it could be months before a vice chairman sits at the table to make policy.

This delay influenced the thinking of the New York Fed board of directors, which effectively agreed with the White House that the Fed needs a leading economist in a top role, according to a person familiar with their thinking. The absence of a nominee from the White House tipped the hand of the board in favor of Williams over a candidate that was either diverse, or one who had expertise in financial regulation.

The shift in emphasis was not lost on outside observers.

"The choice of Williams… would in effect have chosen to prioritize monetary policy expertise over first-hand experience of financial markets and diversity considerations pushed by some,'' wrote Krishna Guha, Fed watcher at ISI Evercore and a former NY Fed official.

Fed-Up, a nonprofit group that has agitated for low interest rates and more diversity at the Fed, issued a critical press release on the news, which first appeared in Saturday's Journal.

"The search for the next New York Fed president began with commitments to diversity and gestures toward public engagement and has ended with the appointment of Williams, a white, male, Fed insider who had never been mentioned before," said Fed Up Campaign director Shawn Sebastian in the statement.

White House officials have repeatedly blamed Democrats in Congress for the delay in nominations. They say they are loathe to nominate people to jobs when it takes month for the Senate to consider them. Senate Democrats have insisted on 30 hours of debate for each nominee. Williams does not have to be confirmed by the Senate.

-- CNBC's Chloe Aiello contributed to this report.