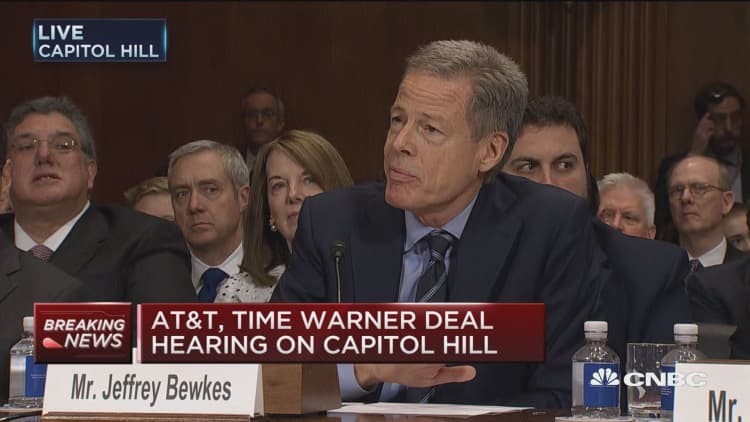

When Time Warner CEO Jeff Bewkes took the stand in the AT&T-Time Warner antitrust trial on Wednesday, he painted a grim picture of the state of traditional media in the internet era.

Bewkes hit back at the government's claim that the post-merger combined company would be more likely to risk blackouts in contract negotiations with competitors.

"No, I don't agree," Bewkes said. "If our channels are not on, we lose a lot of money .... hundreds of millions of dollars in advertising revenue and subscription revenues."

"Tectonic changes" in the media industry have rendered traditional networks, like Time Warner, ineffectual advertisers, Bewkes argued, as evidenced by falling advertising revenue and the decline of pay-TV, as a whole. The new generation of technology companies, like Netflix, Facebook and Google, have the data and resources to serve the right ads to the right users.

"This combination gives us a good chance to compete effectively in digital advertising and direct to consumer distribution," Bewkes said.

Bewkes is the highest profile executive to testify so far. AT&T CEO is expected to take the stand later this week.

The trial is entering its fifth week. The $85 billion deal has faced criticism since it was announced in October 2016 — first from then-presidential candidate Donald Trump, and later from the Justice Department.

In November 2017, the DOJ moved to block the deal, arguing AT&T could threaten to withhold Time Warner's programming from other distributors to force higher prices.

IfJudge Leon, who is overseeing the case, believes AT&T will threaten to withhold Time Warner programming from other video distributors, knowing customers could switch to AT&T's DirecTV as an alternative, he may decide a deal wouldn't be in the best interest of consumers.

AT&T counters that the logic doesn't hold, as the point of owning content is to bring in affiliate fees and advertising revenue through distribution. Time Warner also has contracts with existing TV operators, locking the company into distribution deals for years to come.

Critics of the merger have expressed concern that housing content creators and distributors within the same company would be anti-competitive, but AT&T's Randall has argued Netflix and Amazon are allowed to do the same thing.

But when asked if the merged company would coordinate with Comcast and NBCUniversal to slow the growth of online distributors, Bewkes said that claim makes "no sense."

"We want to be on all platforms," Bewkes said. "We want to be in every bundle, everywhere."

— CNBC's Mary Catherine Wellons and Hampton Pearson contributed to this report.

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC and CNBC.com.