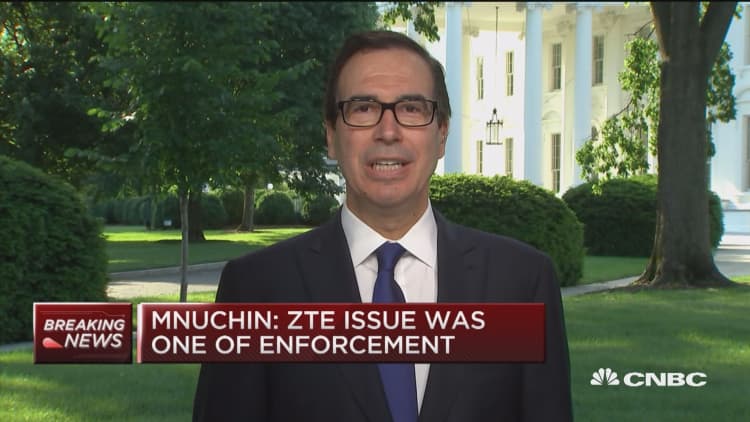

Energy will play a major role in a breakthrough in trade talks between the Trump administration and its Chinese counterparts, Treasury Secretary Steven Mnuchin told CNBC on Monday.

U.S. and Chinese trade negotiators agreed this weekend to put on hold tariffs that they have threatened against one another, after China agreed to purchase more American goods. The concession could move the needle on one of President Donald Trump's major goals: reducing the U.S. trade deficit with China.

To be sure, some economists have flagged challenges to increasing exports to China, from Beijing's ability to facilitate the imports to American farmers and manufacturers producing at or near full capacity.

However, oil and natural gas production is one area of the U.S. economy that is indeed booming. Meanwhile, China, the engine of the global economy, is hungry for more fossil fuels as more drivers take to the nation's roads and the government seeks to generate more electric power from cleaner-burning natural gas.

"In energy, I think there's a massive opportunity for the U.S. to become a major supplier of energy to China," Mnuchin told CNBC's "Squawk Box" on Monday. "They have incredible amounts of demand at these prices for our shale and our liquid natural gas."

"I think we can easily get about $40 or $50 billion of energy, and if we can produce and send more with infrastructure, they can even take more," he said.

That would be an ambitious target. U.S. oil and gas exports to China were worth $4.3 billion in 2017, according to Reuters.

The United States is already doing brisk trade with China, which has emerged as one of the largest purchasers of U.S. oil since the Obama administration reached a compromise with Congress to lift a 40-year export ban on raw crude.

"As the U.S. crude export trade evolves we're seeing a growing trend of [very large crude carriers] being loaded, so that percentage of total exports is around 40-50 percent around any given month and the vast majority of those are heading to China," said Matt Smith, director of commodity research at tanker tracking firm ClipperData.

The shale oil Mnuchin mentioned is extracted using advanced technology to free oil and natural gas from tight rock formations in places like western Texas, the Appalachian region and North Dakota.

Oil output from shale fields is soon projected to rise above 7 million barrels a day and has boosted total U.S. production to about 10.7 million barrels a day, according to preliminary government figures. The U.S. Energy Information Administration projects the United States will average 11.9 million barrels a day next year, surpassing No. 1 producer Russia.

The boom in oil production from western Texas has created bottlenecks in the region, causing prices for regional crude to fall as drillers struggle to get their product to market. Consequently, that oil is now trading at a big discount to international benchmark , making it attractive to foreign buyers.

"When you have a Brent crude price at $80 and when you have a WTI Midland price at close to $20 below that, that's only going to incentivize more crude oil exports leaving the United States and the growing trend of large vessels heading to Asia, and particularly China," Smith said.

Mnuchin made clear on Monday that the trade will occur between companies, and it will have to be in the interest of both Chinese and U.S. firms.

China has historically used its leverage as the world's second-largest oil consumer to influence crude prices, taking advantage of discounts among different grades of crude from around the world. However, the type of light, sweet crude that comes from shale is ideal for many Chinese refineries.

The Trump administration has already made progress opening the Chinese market to U.S. natural gas exporters. A year ago, the U.S. Commerce Department reached an agreement with Chinese authorities that allowed state-owned companies to negotiate long-term contracts with U.S. natural gas exporters, something Beijing had been hesitant to do.

In February, Cheniere Energy became the first American company to sign such a contract, inking a deal with China National Petroleum to supply 1.2 million tons per year from Cheniere's Sabine Pass export terminal on the Texas-Louisiana border. China's total imports of liquefied natural gas, or LNG, were 26.1 million tons in 2016, according to IHS Fairplay.

However, exports of U.S. LNG — natural gas cooled to liquid form — will be limited in how much they can help reduce the U.S. trade deficit with China, at least in the short term.

There are currently only two functional export terminals in the Lower 48 United States: the Sabine Pass facility and Dominion Energy's Cove Point, Maryland, terminal, which started commercial operation in April. Three more are slated to come online through 2019, and the existing terminals are adding capacity.

According to Mnuchin, Chinese companies are preparing to enter a binding agreement to purchase LNG from a $43 billion gas project in Alaska. He said that deal could generate about $10 billion a year.

The Alaska Gasline Development, the project developer, could not immediately be reached for comment on Mnuchin's forecast.