Disney is expected to add cash to its bid for Twenty-First Century Fox assets, sources tell CNBC.

The sources spoke days after CNBC parent Comcast launched a $65 billion cash bid for the assets, which include Fox's movie studios, networks National Geographic and FX, Star TV, stakes in Sky, Endemol Shine Group and Hulu as well as regional sports networks. Comcast's bid was a 19 percent premium to Disney's offer.

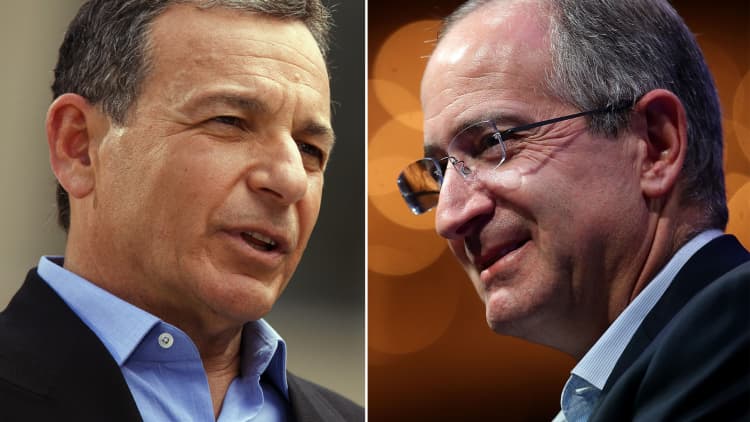

Earlier, Disney reached an agreement with Fox to buy the assets for $52.4 billion in stock, and that bid has gained in value to about $55.5 billion. CNBC has reported the company was willing to add cash if needed to win the bidding.

Fox's board meets Wednesday to discuss Comcast's bid, and would engage in talks if it deems the offer superior. If that happens, Disney has five days to match Comcast's offer.

Disney shares closed down 1.6 percent on Monday, Comcast was down 3.8 percent and Fox was down 0.4 percent.

Earlier Monday, Pivotal Research Group downgraded Disney shares to a sell rating, saying it is boxed into a corner on the bidding, and a higher deal price would reduce the value of Disney to its shareholders. On the flip side, losing the deal would also be a negative because Disney wouldn't be able to realize the savings it wants to produce from the transaction, the research firm wrote.

Comcast's bid came a day after a federal judge cleared the way for AT&T's acquisition of Time Warner, a deal the government had tried to block on competitive grounds. The decision was expected to set off a new wave of big company mergers.

The Fox assets would boost Comcast's presence internationally and shore up its entertainment units at a time when consumers are shunning traditional cable operators in favor of internet-based video streaming such as Netflix.

Comcast had gone after the Fox properties before, but Fox, controlled by the Murdoch family, chose Disney. In launching the bid last week, Comcast CEO Brian Roberts said in a letter to Fox's board, "We were disappointed when [Fox] decided to enter into a transaction with The Walt Disney Company, even though we had offered a meaningfully higher price." He added, "We are pleased to present a new, all-cash proposal that fully addresses the Board's stated concerns with our prior proposal."

Disclosure: Comcast is the parent company of NBCUniversal and CNBC.