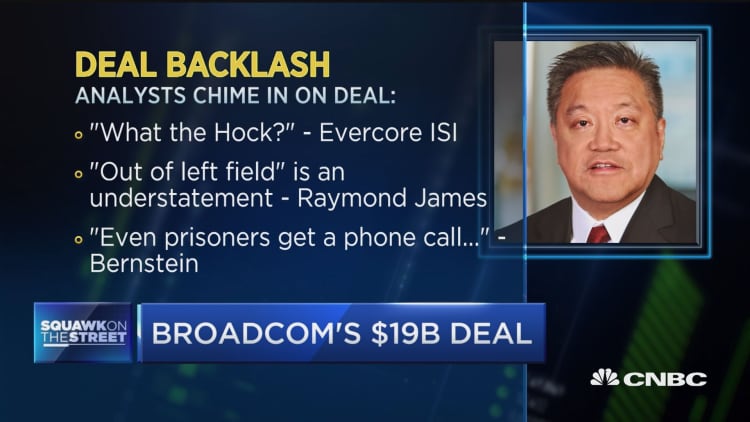

Wall Street is buzzing over Broadcom’s befuddling strategy to acquire a low-growth software company.

On Wednesday after the market close Broadcom announced it had entered into an agreement to purchase software company CA Technologies for $18.9 billion.

Raymond James told its clients it was surprised by the deal announcement and questioned the company's rationale.

“To say the deal came out of left field is an understatement. We see no obvious business synergies between Broadcom’s semiconductor business and CA’s Software business,” analyst Chris Caso said in the report Wednesday. “This deal, since it is so far afield from Broadcom’s core businesses, will likely cause significant confusion about the company’s strategy.”

Broadcom shares declined 13.8 percent Thursday, representing a drop in stock value of $14.5 billion. The company’s market value was $105 billion as of Wednesday’s close, according to FactSet.

One Wall Street firm said the change in strategy to buy a software company versus its historical pattern of purchasing semiconductor companies will hurt management’s standing with investors.

“CA is a legacy software company that specializes in mainframes - shared synergies are not obvious,” Nomura Instinet analyst Romit Shah said in a note to clients Thursday. “More important is that this deal runs completely against the investment narrative that management has been articulating. … Management has stressed that Broadcom is focused on delivering shareholder value through organic growth, capital return and tuck-in acquisitions. This deal hurts management’s credibility, in our opinion.”

Shah reiterated his neutral rating and lowered his price target to $225 from $250 for Broadcom shares. The stock closed at $243.44 Wednesday.

Mizuho Securities said its clients are worried that Broadcom may not succeed in the software business given Intel’s previous trouble in the same industry.

“We are getting investor pushback with an unexpected surprise at a big software acquisition as it potentially strays from AVGO's hardware focus with little overlap with current strategy,” analyst Vijay Rakesh said Wednesday in a note. “We believe investors are smarting from prior unsuccessful software M&A such as INTC buying McAfee and Windriver, both of which INTC recently divested to private equity.”

Rakesh reaffirmed his buy rating and $310 price target for Broadcom shares.

In a filing with the SEC, the company announced Silver Lake managing partner Ken Hao resigned from the board of directors of Broadcom effective Wednesday. Hao was a key adviser in formulating Broadcom's strategy of acquiring semiconductor companies.

"Mr. Hao is stepping down to proactively avoid any potential conflicts of interest that could arise from his role as a director of Broadcom following its proposed acquisition of CA and as a director in current and future portfolio companies of Silver Lake," the filing said. "Mr. Hao’s resignation was not the result of any disagreement between Mr. Hao and Broadcom."

When asked for comment, a Broadcom spokesperson said, "We’re confident we can create value for shareholders.”

WATCH: Why this CIO prefers newer chip companies