General Motors shares tumbled Wednesday after the largest U.S. automaker cut its profit outlook for the year, citing higher costs for raw materials and unfavorable foreign exchange rates in South America. Steel and and aluminum prices have been on the rise since the Trump administration imposed tariffs on the auto industry's two key raw materials.

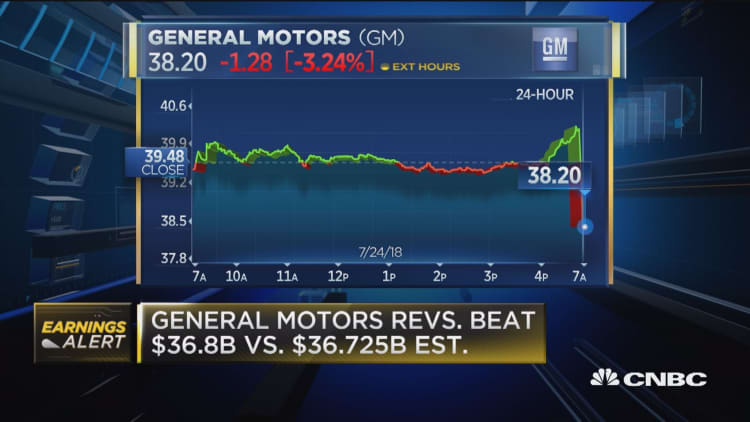

The automaker now expects to earn about $6 per share in 2018, down from its previous forecast of $6.30 to $6.60 a share. GM shares were down more than 6 percent shortly before 1 p.m., on track for its steepest one-day percentage decline since November 2011.

Rival Fiat Chrysler on Wednesday also cut its outlook for the year and its shares were down more than 11 percent. Ford, which reports after the market closes on Wednesday, was down close to 4 percent.

"Recent and significant increases in commodity costs and unfavorable foreign exchange impact of the Argentine peso and Brazilian real have negatively affected business expectations," GM said in its earnings release, adding that it "anticipates these headwinds will continue" through 2018, headwinds will cost it $1 billion this year.

Investors are focusing on the impact of higher commodity costs as a trade war escalates. On Tuesday, shares of Whirlpool plunged after the U.S.-based washing machine maker said higher steel costs will crimp its profits this year.

In the second quarter, GM said net income rose more than 40 percent to $2.39 billion, but from its continuing operations, profits fell slightly from a year earlier.

On an adjusted basis, which strips out one-time items, GM earned $1.81 per share, which was higher than the $1.78 per share expected by analysts surveyed by Thomson Reuters.

Revenue in the three months ended in June came in at $36.76 billion, slightly higher than estimates, but down 0.6 percent from a year earlier.

U.S. demand grew for high margin SUVs and trucks, GM said, with vehicle deliveries rising 4.6 percent to 758,000 in the three months ended in June. The automaker had cited a strong economy behind an increase in sales. Its Chevrolet and GMC pickups and large SUVs were up 21 and 22 percent, respectively.

GM China's deliveries increased to an all-time high of 858,000 in the second quarter, said GM.

Automakers have said that tariffs could drive up vehicle costs and lead to job cuts. However, it its earnings release, GM did not mention the tariffs and its CFO said the price moves were due to "market forces."

Both Ford's and GM's stock prices have lagged the broader market, with GM shares down 3.7 percent this year and Ford's down more than 15 percent, compared with the S&P 500's gain of more than 5 percent.