The boss of influential bond investor Bill Gross told CNBC on Thursday that the billionaire guru "has been wrong and wrong badly" this year.

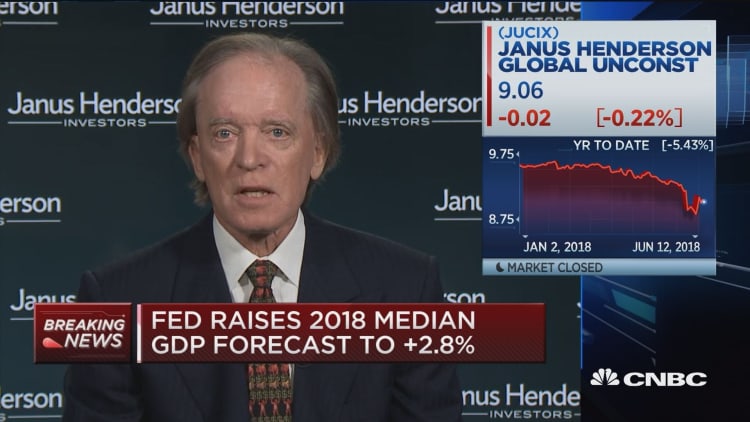

Gross is the portfolio manager of Janus Henderson Global Unconstrained Bond Fund, which suffered more than $200 million in redemptions last month, according to Bloomberg, lowering assets to $1.25 billion from $2.24 billion in February.

The fund is down 7 percent this year and ranks in the last percentile of funds in its category, according to Morningstar.

Janus Henderson CEO Richard Weil addressed Gross' fund performance in an interview with "Worldwide Exchange." Weil told CNBC's Brian Sullivan that Gross admits that he "has made some bad bets."

"He believes still in his basic presumption that inflation is not going to get out of control," Weil said. "And so he hasn't lost faith in his fundamental view. But he's been wrong and wrong badly in the short term. And he's accountable and we're accountable for that."

But Weil also said that "nobody is less happy about [Gross'] investment performance than he is." He said Gross is "still one of the greatest investors of our lifetime. So, he's just got to work it through."

In June, Gross told CNBC that he's still banking on what he's calling the "trade of the year," which is a bet that German bond prices will fall while U.S. Treasurys will rise.

The 10-year German bund yield was at 0.05 percent Thursday, while the 10-year Treasury yield was near 3 percent. Bond prices move inversely to yields.

"One of these days, and hopefully soon, that difference has got to be narrowed," he said at the time. "In the meantime, there's some volatility as the bund does better based upon weakness in Italy ... or as Treasury [yields] go up based on upon a Fed decision."

CNBC reached out to Gross for a reply to Weil's comments.

WATCH: Bill Gross still confident in his 'trade of the year'