Rep. Chris Collins' son and his son's fiancee bought shares of an Australian biotech company just days before dumping the shares after the New York Republican allegedly tipped his son off about a failed clinical drug trial in a phone call from the White House lawn, the Securities and Exchange Commission said in a complaint.

Collins' son, Cameron Collins, and the son's accountant fiancee, Lauren Zarsky, had purchased the stock of Innate Immunotherapeutics in June 2017 because they believed — mistakenly, it turned out — that the trial of the company's multiple sclerosis treatment would yield positive results, the SEC said in its complaint.

The complaint was filed at the same time as a federal criminal indictment Wednesday accusing Chris Collins, Cameron Collins and Zarsky's father Stephen Zarsky of insider trading. It details how and why Lauren Zarsky's parents started investing in Innate in September 2016.

Chris Collins, who represents a Buffalo-area district, had been touting Innate Therapeutics' prospects for years. At the time, he was a member of the company's board of directors, even while serving in Congress. Chris Collins also was Innate's biggest shareholder in early 2016, owning more than 17 percent of the company, or almost 34 million shares.

Cameron Collins and his sister Caitlin were the third- and fourth-largest shareholders, with each owning 2.65 percent of the company at that time, or 5.2 million shares apiece.

"I think we all need to consider investing in innate therapeutics," Lauren Zarsky wrote her mother Dorothy in a text message in August 2016, according to the SEC complaint.

"I might put in $15k and that has a greater than 50% chance of going up to $250k ... that is actually unheard of and cams dads almost guarantees it within the next 1 to 2 years."

The next day, Lauren texted her mom: "And we'll always keep in touch with cams dad who I'm guessing would know how things are looking as we get closer to the end of the trial," the complaint said.

Several days later, the complaint alleges, "She told her mother, 'I'll make sure cams dad keeps us in the loop.'"

In September 2016, Stephen Zarsky and his wife, Dorothy, bought a total of 250,000 shares of Innate Therapeutics between the two of them.

With subsequent purchases by Stephen, the couple ended up owning a total of 353,005 shares of the company, the SEC said.

The failed trial

The following April, Innate revealed publicly that the last patient had finished the clinical portion of the trial of its multiple sclerosis drug, M1S416, and "that the final results would be available in August or September of 2017," the complaint said.

Chris Collins learned in June that he and other directors would not be allowed to trade in Innate's stock between June 5 and July 11, 2017, because the results of the trial were planned for release around that time. Innate's CEO emailed Collins and other directors on June 9 to say that data from the trial had been sent to the company's consultants and that the "verdict" would be delivered June 22, the complaint said.

Cameron Collins on June 15 "opened a new brokerage account and used funds from his 401(k) account to purchase 16,508 extra shares," according to the SEC.

"Likewise, five days later, Cameron Collins' girlfriend invested in Innate for the first time on June 20, 2017, buying 40,464 shares in a brokerage account that she had opened the previous day," the complaint said.

Two days later, authorities allege, Chris Collins got an email along with other Innate board members from the company's CEO, who told them he had "extremely bad news to report," as the results of the trial "pretty clearly indicate 'clinical failure.'"

"Within about 15 seconds of sending his email response" to the CEO from the South Lawn of the White House, where he was attending a congressional picnic, Collins began trying to contact his son, and eventually reached him for a six-minute discussion on the phone, the complaint said.

Authorities said that Cameron Collins, who was with Lauren Zarsky at the home they shared in New Jersey, soon afterward went to her parents' house.

The next day, all four of them, as well others allegedly tipped off about the still-secret clinical test results, began selling off their shares in Innate, according to authorities.

Fighting the charges

Chris Collins himself did not, and actually could not, sell any of his shares in Innate because they were held in an Australian account, before the company's stock price cratered on the heels of public disclosure of the test results.

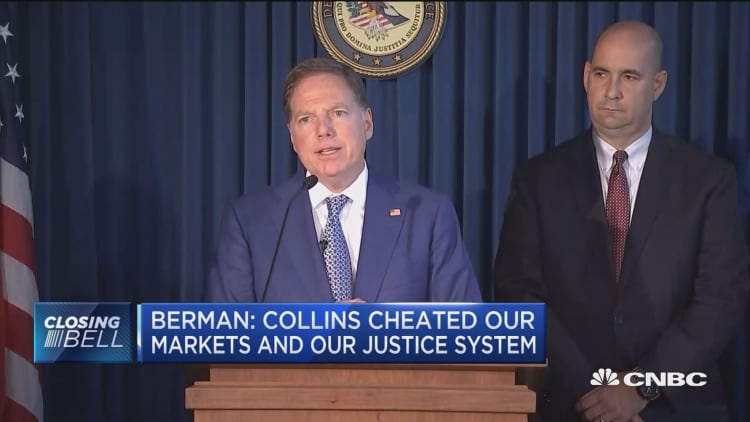

Federal prosecutors in New York have said that as a result of Chris Collins "illegal tips" Cameron Collins, Stephen Zarsky and others who received inside information about the clinical trial "avoided a total of approximately $768,000 in losses."

All three of those men are charged with insider trading, as well as with making false statements to authorities in an alleged bid to cover up the scheme, prosecutors said. They all have pleaded not guilty.

"I believe I acted properly and within the law at all times," Collins said at a news conference Wednesday night in which he also vowed to stay in the race to retain his seat in Congress.

Each of the men is also being sued by the SEC.

Neither Lauren Zarsky nor her mother were criminally charged. However the SEC said related civil charges against the two women have been settled.

"Lauren Zarsky agreed to disgorge her ill-gotten gains of $19,440, plus prejudgment interest of $839, and pay a civil penalty of $19,440," the SEC said in a press release.

"Dorothy Zarsky agreed to disgorge her ill-gotten gains of $22,600, plus prejudgment interest of $975, and pay a civil penalty of $22,600."

"Lauren Zarsky, a CPA, has also agreed to be suspended from appearing or practicing before the SEC as an accountant, which includes not participating in the financial reporting or audits of public companies," the agency said.