Treasury Secretary Steven Mnuchin says he's not worried about a difference in interest rates that the bond market considers to be a warning about the economy and a potential recession.

The difference between short- and longer-term rates is normally ignored. But the market starts to notice when they get closer to one another, what traders call "flattening," and especially when the short term rate spikes above the longer-term one, something known as an "inverted yield curve," which has long been the harbinger of tougher times.

The curve has been flattening all summer.

The difference in rates between the Treasury's and 10-year notes reached a slim 18.8 basis points Friday, and the concern is that they will invert. Once that happens, it is considered a reliable warning that recession could be months to a year away.

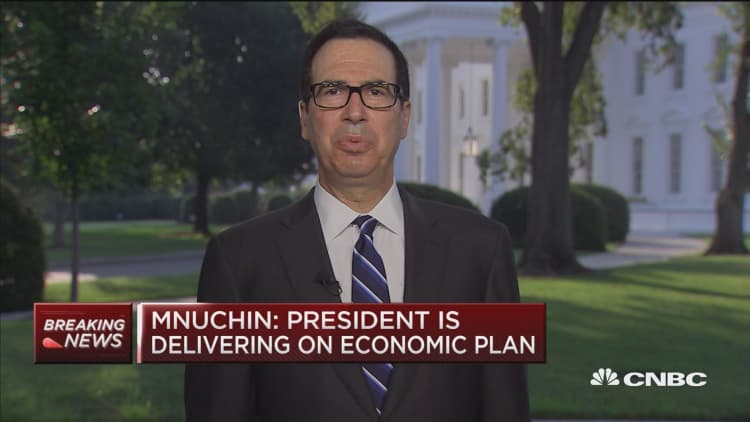

The Treasury secretary, however, isn't alarmed. "I, for one, am not at all concerned about the yield curve. I don't think that's a predictor of economic growth," Mnuchin said Tuesday on CNBC's "Squawk Box." "I think it's a market condition, and for now having a flat yield curve with us issuing long-term debt is something we're perfectly content with."

The yield on the 10-year yield was at 2.87 percent Tuesday, well off its recent high above 3 percent. The 2-year, which most represents Fed rate hikes, was at 2.64 percent. On Tuesday, the difference between the two widened to just under 22 basis points.

"The weakness in housing, the high valuation in the stock market, corporate indebtedness, there are 1,001 things we can talk about. The yield curve has been a reliable signal of recessions. It's telling us something," said David Ader, Informa Financial Intelligence chief macro strategist. "The odds would say yes, so maybe it is important."

Ader said the curve move is different this time because the Fed used quantitative easing after the financial crisis to add liquidity to markets. It helped subdue longer-end rates, but still as the Fed moves away from QE, its program to unwind its balance sheet and allow Treasury securities to run off has not helped to steepen the curve.

"I think the yield curve is an issue, and we're going to have this debate all the way into the next recession. The yield curve is heading toward inversion. Two more rate hikes will do it," Ader said.

Fed officials are also divided on whether the flattening curve is an issue, with a number of them dismissing it as a problem. Mnuchin said Tuesday he respects the Fed's independence and sees Chairman Jerome Powell as a "phenomenal leader."

That conflicts with recent comments from President Donald Trump, who criticized the Fed's rate hiking policy as being bad for the economy, and he said he was not "thrilled" with Powell.

Strategas Research's Thomas Tzitzouris said in a note Tuesday that the curve is reflecting the market's "semi-passive strategies," which are betting heavily against the risk of rising inflation.

"Rather, a negative term premium is a DIRECT manifestation of a worry that the Fed is likely to commit a policy mistake in an environment with a dangerously low nominal growth cushion," said Tzitzouris, head of fixed income research.

The strategist said the market's term structure of inflation expectations should never be flat from five to 30 years, and it's currently flatter than it was at the start of the last recession and end of the previous recession. "There's no way to deny it; the market doubts inflation will reach target in the next 30 years, and it doubts that there will even be an acceleration towards target in the next 5, or even 10 years. If the Fed sees past this market stance, and still sees the need to tighten another 150 bps from here, it's hard to see how this curve doesn't invert well before the Fed Funds rate reaches 3.50%," he wrote.

The Fed has signaled it is comfortable with a moderate level of inflation, which has been below its 2 percent target, when measured by the PCE deflator, its favored inflation gauge.

Ader said a positive for the Treasury would be if it was now considering using the low rates on the long end to issue new longer-duration debt, as Mnuchin has previously discussed. There are no current plans for longer-duration bonds.

"What an opportunity for them now to start issuing 40- and 50-years debt. It might make [the curve] widen but it you're a prudent secretary of Treasury, your job is to fund our deficit at the lowest possible cost. A flatter yield curve allows them to do it at the lowest possible rate. I suspect they will at some point, and the majority of the debt is being extended anyway," he said.

WATCH: Mnuchin on tariffs