Russia is now much closer to China than the U.S., the head of Russia's sovereign wealth fund told CNBC Tuesday, with a strategic partnership between Russian firms and Alibaba the latest example of their strengthening ties.

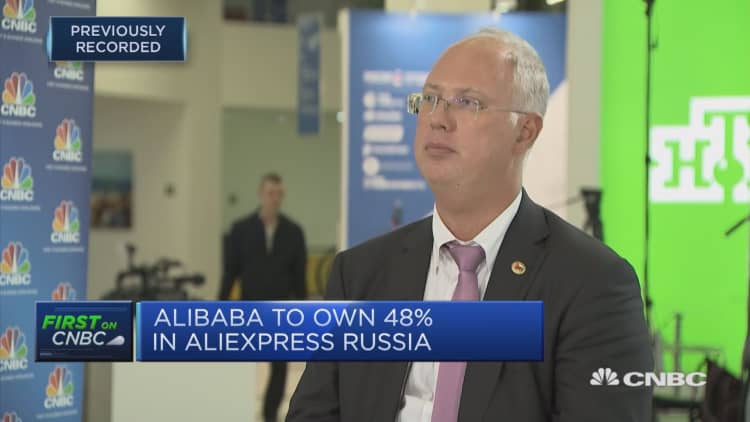

"Frankly we do much more with China generally, we believe in integration, we believe in working together, President Xi (Jinping) and President (Vladimir) Putin are positive about this transaction," Kirill Dmitriev, the chief executive of the Russian Direct Investment Fund (RDIF), said at the Eastern Economic Forum in Vladivostok, Russia.

"So yes, of course Russia and China are much closer now than Russia and the U.S." He put the schism with the U.S. down to "geopolitical difficulties" and said, "we believe we need to overcome this and do more great joint projects together, even with the U.S."

Dmitriev's comments come hours after a strategic partnership between Russia's sovereign wealth fund and Chinese e-commerce giant Alibaba was announced. The deal will allow both sides to make the most of each others' customers and products, Dmitriev said.

"Alibaba is $410 billion company and it's a great partner for us because it's the first time in the world that we have a merger between e-commerce, social network and telecom operator, all taking e-commerce forward. But not only this, artificial intelligence, logistic infrastructure (too)," he said, speaking to CNBC's Geoff Cutmore.

Earlier on Tuesday it was announced that Alibaba had signed a partnership with a number of Russian firms including RDIF. The venture will see the creation of a new e-commerce platform and will utilize Russia's own payments system. The agreement includes mobile operator MegaFon and internet group Mail.ru and is aimed at integrating Russia's key consumer internet and e-commerce platforms, and also launching a leading social commerce joint venture in Russia.

The deal is the largest of a series of business deals between Russia and Chinese firms announced Tuesday at the Eastern Economic Forum in Vladivostok, Russia.

"It's a great example of cooperation between Russia and China because we are doing a lot of investments together but technology is a great new frontier and we want to pursue it together," Dmitriev added.

The deal with Alibaba made sense, he added, because the firm was already invested in Russia and was growing there. "It's growing 50 to 70 percent a year and taking the highest market share in e-commerce in Russia. (It has) 600 million customers that some of the Russian businesses can supply products to. Mail.ru, which is our partner with us in this deal, has 100 million Russians who will get more Alibaba products."

Alibaba added Tuesday that the aim is to create a one-stop destination for consumers to communicate, socialize, shop and play games, all within the same online ecosystem. A Financial Times article last week also likened the venture to a digital version of China's silk road initiative.

Sovereign wealth funds like RDIF are state-owned investment vehicles that enable countries to save surplus revenues and invest in a variety of assets on behalf of a nation.

RDIF has $10 billion of capital under management and makes direct investments in Russian companies. It has also attracted over $40 billion of foreign capital into the Russian economy through long-term strategic partnerships, RDIF says in a statement on its website.

—CNBC's Matt Clinch contributed reporting to this story.