If you're waiting for more tax cuts to come out of Congress, you may be waiting a while.

The House Ways and Means Committee on Thursday approved several bills that Republicans have dubbed Tax Reform 2.0. The legislation would make the recently reduced tax rates for individuals permanent and would expand tax-advantaged savings accounts, including for retirement and education.

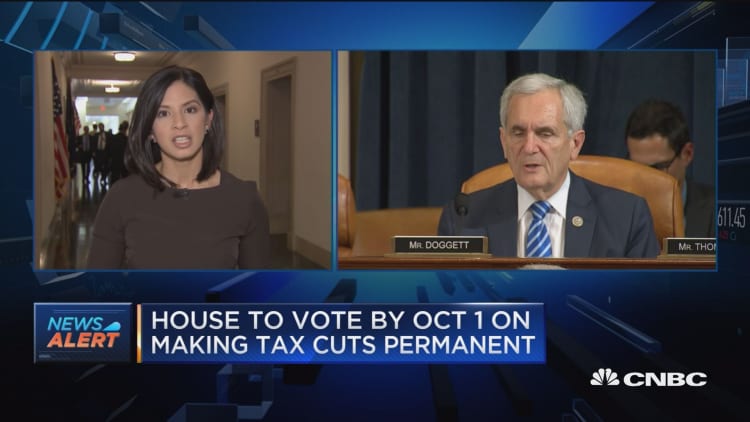

House Speaker Paul Ryan and Majority Leader Kevin McCarthy have said publicly that they will hold a floor vote on the bills by the end of the month. However, even if the legislation passes in the Republican-controlled House, it's expected to stall after that, with the Senate unlikely to take it up until after the midterm elections — if at all.

"It's possible it will get through the House, although it's unclear when a vote might happen because they're running out of legislative days before the midterm elections," said Nicole Kaeding, director of federal projects for the Tax Foundation, a nonpartisan tax-policy research group. "But it's highly unlikely it would see a vote in the Senate."

In addition to a lack of Democratic support — which would be needed to clear the 60-vote hurdle for the bills to pass in the Senate — there's been lackluster public backing for the already-passed tax cuts that took effect this year. A poll released last month by Monmouth University shows that 37 percent of the public approve, while 45 percent disapprove.

One of the new legislative package's biggest sticking points is its price tag: an estimated $627 billion over the next decade, according to a recent analysis by the Joint Committee on Taxation. That's on top of the $1.5 trillion the already-passed tax cuts are projected to cost over the next decade.

Additionally, one of the measures would make permanent the controversial $10,000 cap on the deduction for state and local income taxes. Some Republican lawmakers from high-tax states such as New York and New Jersey oppose the "SALT" limit and have said they won't support extending it.

Even if the tax-reform 2.0 bills end up shelved this year, they could be revived next year when a new Congress is in place or at another time in the future, depending on the balance of power.

"It'll be a conversation based on what the makeup of the House and Senate are after the elections," Kaeding said. "I'm sure [Republicans] will continue trying to make some parts permanent, but they also have time because those don't expire until 2025."

Here are some highlights of the bills.

Making tax cuts permanent

The first bill is called the Protecting Family and Small Business Tax Cuts Act of 2018 (H.R. 6760). In addition to making permanent the cuts to individual tax rates that took effect this year, it would also lock in other changes that are set to expire at the end of 2025.

That means the doubled standard deduction and elimination of personal exemptions would become permanent, along with the increased child tax credit, the elimination of most deductions and the $10,000 SALT cap. The higher federal estate tax exemption of $11.2 million per individual also would be extended.

Reduced tax rates through 2025

| Rate | Single | Head of household | Married filing jointly |

|---|---|---|---|

| 10% | Up to $9,525 | Up to $13,600 | Up to $19,050 |

| 12% | $9,526 to $38,700 | $13,601 to $51,800 | $19,051 to $77,400 |

| 22% | 38,701 to $82,500 | $51,801 to $82,500 | $77,401 to $165,000 |

| 24% | $82,501 to $157,500 | $82,501 to $157,500 | $165,001 to $315,000 |

| 32% | $157,501 to $200,000 | $157,501 to $200,000 | $315,001 to $400,000 |

| 35% | $200,001 to $500,000 | $200,001 to $500,000 | $400,001 to $600,000 |

| 37% | Over $500,000 | Over $500,000 | Over $600,000 |

Separately, the bill would continue the higher deduction for medical expenses. Under rules implemented in last year's tax legislation, qualifying medical expenses in excess of 7.5 percent of your adjusted gross income can be deductible if you itemize. Instead of letting that floor rise to 10 percent in 2019 as scheduled, H.R. 6760 would extend the lower threshold through 2020.

The measure also would make the 20 percent deduction for so-called pass-through businesses permanent.

A focus on savings

The second bill, the Family Savings Act of 2018 (H.R. 6757), includes changes to retirement and education accounts and creates a new tax-deferred savings account.

For starters, the measure would remove the age limit on individual retirement account contributions. Currently, IRA owners cannot make additional contributions beginning in the year they turn 70½. Roth IRAs, by contrast, do not have a contribution age limit.

It also would exempt people with less than $50,000 in their retirement accounts from taking required minimum distributions, which start when you turn 70½. It also would allow families to withdraw up to $7,500, penalty-free, from retirement accounts for costs related to a new child, whether by birth or adoption.

More from Personal Finance:

Here's how some of the wealthiest people are investing their cash

Dodd-Frank changed consumer protections after the financial crisis — here's how that's shaking out today

The best and worst college majors for your money

Additionally, 529 education account could be used to cover the cost of home schooling, for fees related to a trade apprenticeship and to help pay off a student debt.

The bill also endorses Universal Savings Accounts, which would allow savers to set aside tax-advantaged money for basically anything.

The accounts, which would come without restrictions on when (or why) the owners can make use of them, would work similarly to Roth IRAs. Up to $2,500 of after-tax income yearly could be contributed to an account, while the withdrawals — including any investment gain or interest — would be tax-free.

Another provision would allow smaller firms to more easily band together to offer their employees a 401(k) plan. As it stands, so-called multiple employer plans restrict exactly which businesses can team up.

For start-up businesses

The third bill is called the American Innovation Act of 2018 (H.R. 6756). Just 15 pages long, it would let new businesses deduct up to $20,000 in start-up expenses in the year they are incurred as long as they meet certain qualifications.